Is it too soon for investors to start talking about the 2024 presidential election? Apparently, not. Though the Iowa caucuses are still three months away and the general election is a year off, a surprising number of investors have already begun expressing concern about what’s to come in the race for the White House.

In a September survey about the markets, investors were asked what they fear could negatively impact the performance of their investments over the coming 12 months. A majority—52%—cited next year’s presidential elections, according to the Investopedia poll.1 That was the second-biggest worry overall, trailing only inflation. In fact, more investors expressed concern about how the 2024 vote could unsettle the markets than a potential recession, persistently high interest rates, and fallout from geo-political worries such as the war in Ukraine and now the war between Israel and Hamas.

Is this level of concern warranted?

What History Says About Election Markets

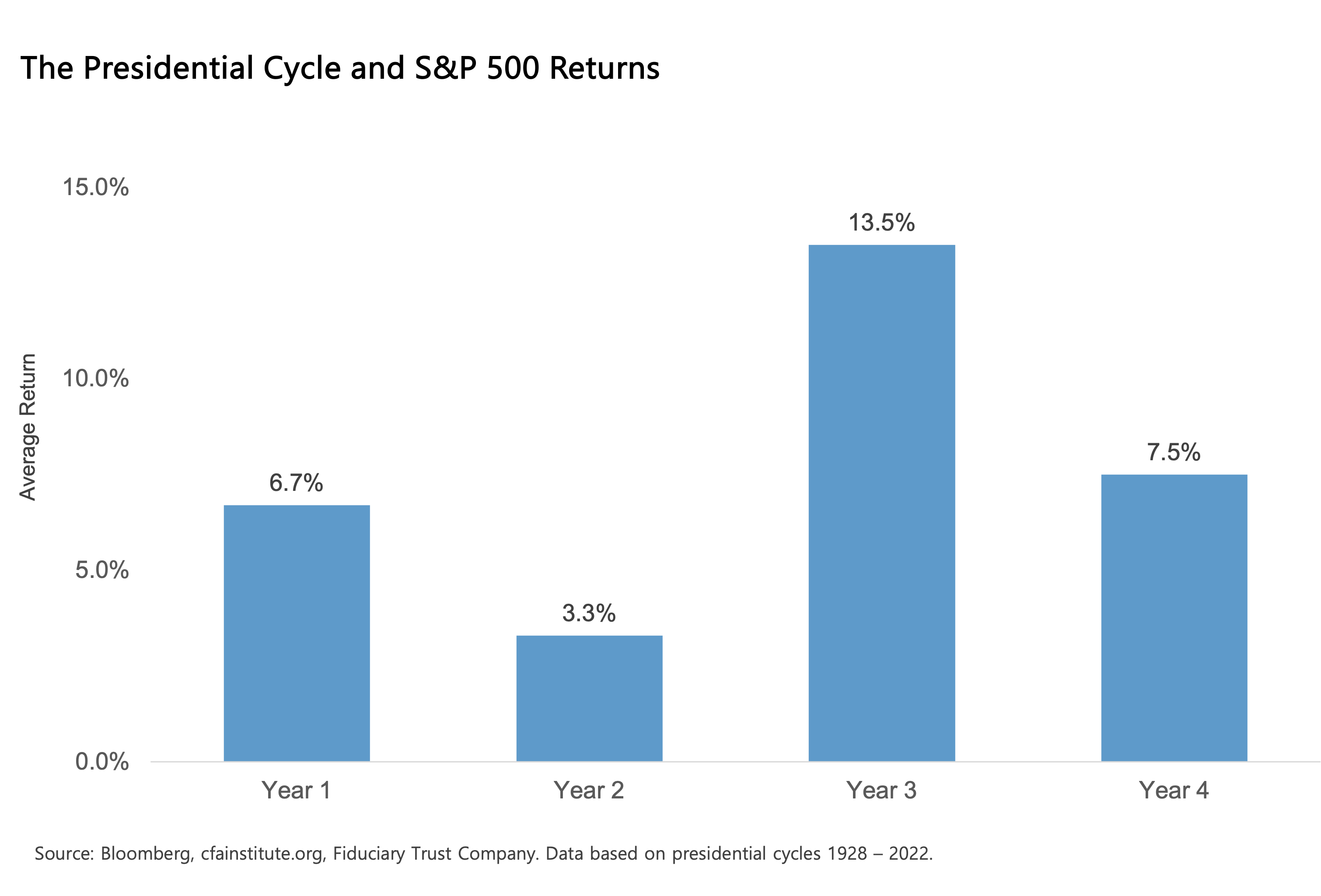

While it’s true that elections have consequences, there is little evidence indicating that investors need to alter their strategies based on who occupies the White House. In fact, since 1932, years leading up to a presidential election and election years themselves have been the best two periods for stock market returns, on average, over a four-year presidential cycle.

What’s more, investors’ portfolios have been able to flourish under almost every presidential administration in modern history—under both Democratic and Republican control of Washington. Since 1932, stocks have returned 13% a year when the GOP controls the White House, Senate and House of Representatives. When Democrats control the White House and Congress, stocks have returned 10% annually. Even despite potential gridlock, historical returns are positive. Under a Democratic president and GOP-controlled Congress, stocks have gained 13% annually. With GOP presidents and Democratic-controlled Congresses, equities have gained roughly 5% annually.2

The Real Risk of Election Markets

What investors should focus on is not making short-term moves based on political assumptions that may wind up being wrong. The fact is, the markets have a knack for surprising investors, even when moves may seem like “sure things.”

For instance, conventional wisdom said that entrepreneurs would benefit under the Reagan Administration’s de-regulatory, pro-business policies, certainly more so than they did under his predecessor, Jimmy Carter. But while small company stocks gained more than 85% under former President Ronald Reagan’s two terms in office, they did far better under former President Carter’s one term—up 120% from Jan. 20, 1977 to Jan. 20, 1981.3

The so-called smart money also said healthcare stocks were at risk under former President Barack Obama, who announced a comprehensive healthcare reform proposal during the 2008 campaign. This included calling for a national health insurance exchange and prohibiting private insurers from denying coverage based on pre-existing conditions. Yet healthcare stocks outperformed the broad market under the Obama Administration’s eight years in office.4

Similarly, in the 2016 campaign, Donald Trump promised to withdraw from the Paris Climate Accord while vowing to promote more drilling for fossil fuels. This seemed like bad news for sustainable investing strategies promoting pro-environmental investments. Yet during former President Trump’s four years, clean energy stocks soared nearly 280%.5

Perhaps the bigger risk in an election year is that investors let their emotions change their approach to investing, whether consciously or not. A 2012 study conducted by professors at the University of New Hampshire, University of Miami, and BYU hinted at this possibility.6 The study, titled “Political Climate, Optimism, and Investment Decisions,” looked at investor market exposure between 1988 and 2000. It found that investors became less optimistic about the economy when their party was out of power, while perceiving the markets to be less risky and more undervalued when their party was in power. This led investors to become more conservative after a defeat while increasing their allocations to risk assets when their party won.

Of course, politics shouldn’t dictate asset-allocation decisions. Allocation should be guided by one’s spending needs and priorities, time horizon, and multi-generational goals, with the help of an advisor.

What This Means in 2024

Ultimately, from an investment perspective, what matters in an election year is how investors react, or possibly overreact, to who wins or loses.

The good news is that well-diversified investors with exposure to different asset classes, styles, and geographic regions have historically been able to make money under every president, even if one segment of the market—such as U.S. stocks—might disappoint.

If you would like to discuss the positioning of your investment strategy and how to establish the proper guardrails in this coming election market, please reach out to your Fiduciary Officer or Sid Queler at queler@fiduciary-trust.com.

1 Political Climate, Optimism, and Investment Decisions, Yosef Bonaparte, Alok Kumar, and Jeremy Page. April 2012.

3 Morningstar.com

4 Morningstar.com

5 Morningstar.com

6 Political Climate, Optimism, and Investment Decisions, Yosef Bonaparte, Alok Kumar, and Jeremy Page. April 2012.