October 1, 2024

Now that the Federal Reserve has begun to lower interest rates with the 0.50% September Federal Funds Rate cut, investors find themselves close to where they were at the start of the year, pondering how aggressively the central bank might ease in the coming months and if it can successfully stick a soft economic landing. For those cautiously optimistic about the financial markets — a group we count ourselves among — this represents real progress.

For most of the year, persistent inflation and a resilient job market kept the Fed on pause for longer than expected. In September, though, the Federal Open Market Committee began its first easing cycle since the global pandemic after Chairman Jerome Powell made it clear that the battle for price stability has largely been won. In July, the Personal Consumption Expenditures Index, the Fed’s favorite barometer of inflation, rose 2.5% on a year-over-year basis, a milder increase than was forecast. At around the same time, Powell noted in his annual Jackson Hole address that his “confidence has grown that inflation is now on a sustainable path back to 2%,” the Fed’s stated target rate.1

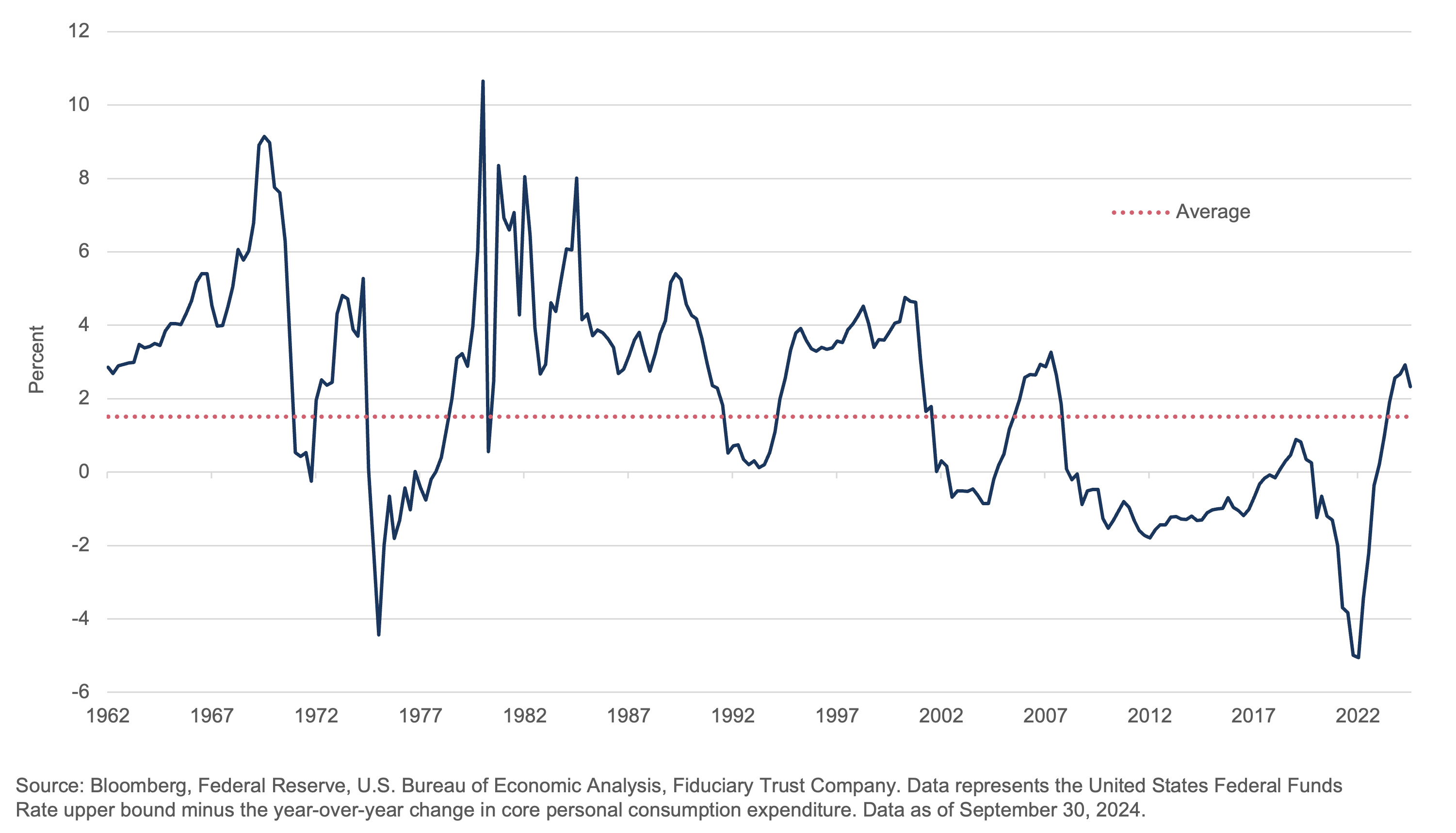

This raises two key questions, the first being: How much more will the Fed cut rates in the coming months? The CME FedWatch tool, a widely followed gauge of the bond market’s expectations, indicates the prevailing view is that the Federal Funds rate will fall to around 4.25% by December, which would signal another 75 basis points of cuts between now and the end of the year.2 With inflation hovering at about 2.5%, this would be in line with history (since 1962, the Fed Funds rate has averaged around 1.5 percentage points higher than the prevailing rate of inflation).3

Exhibit A: Federal Funds Rate Minus Inflation Rate, 1960 – 2024 Q3

The Myth of the Elusive Soft Landing

The more important question is whether this sets the stage for a so-called soft landing. Conventional wisdom says soft landings are incredibly rare. Technically, the Fed has managed to raise rates to cool the economy without triggering a recession only once in recent memory — in 1994 when it hiked rates seven times to keep inflation at bay before cutting rates three times the following year.4 This is why investors routinely wonder at the onset of an easing cycle, whether the Fed might have waited too long to shift its focus away from fighting inflation to supporting the job market.

In truth, there is no official definition of what a soft landing actually looks like. Former Fed Vice Chairman Alan Blinder, who served under Alan Greenspan during the 1994-95 soft landing, says the simple onset of a recession isn’t the only way to measure success. He argues that a “softish” landing is achieved in the aftermath of a tightening cycle if GDP declines by less than 1% or if there is no recession declared by the National Bureau of Economic Research — the independent body of economists regarded as the official arbiter of recessions — for at least one year after rate hikes. By this definition, Blinder concludes that there have been five softish landings since 1965.5

To be sure, the most recent softish landing based on Blinder’s definition was in 2000, after the Fed raised rates by 1.75% starting in 1999 to take some air out of the dot-com bubble. Many economists and investors, including us, considered the recession that followed the bursting of the tech bubble a hard blow, as it led to a bear market in which the Standard & Poor’s 500 Index lost nearly half its value.

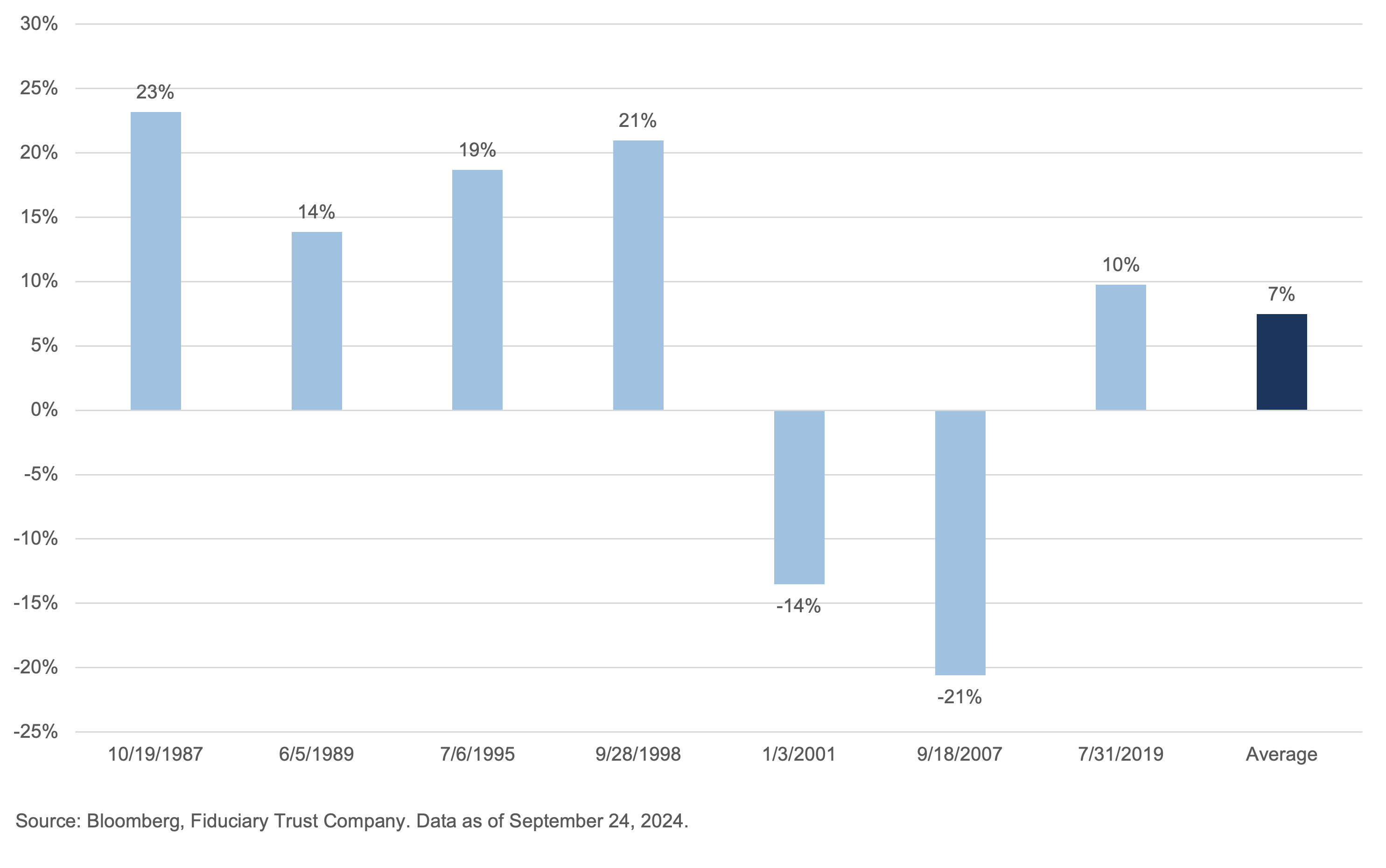

We want to be clear: That is not the type of soft landing we expect to unfold this time. Instead, we anticipate something more akin to 1994-95, when the economy was still growing, inflation was in check, and the unemployment rate was modest and improving. Rate cuts back then set the stage for equities to flourish, with the S&P 500 generating gains of 19% in the 12 months following the start of the easing cycle, as depicted in the chart below.

Exhibit B: S&P 500 Forward 12 Month Returns and Drawdowns After Fed Cutting Cycle Start

Portfolio Considerations

While we cannot count on such outsized gains this time around, we believe it’s more likely than not that the Fed has begun easing against a similar backdrop and can again avoid a recession. This supports our view of being overweight U.S. equities and credit.

There are other reasons to be constructive on stocks, such as the likelihood of improved breadth in the market. For the past two years, a discussion on equities has largely boiled down to one’s views on the near-term health of the Magnificent 7. These seven tech giants — Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla — are seen as early beneficiaries of the artificial intelligence boom and have been responsible for the vast majority of the market’s gains since the start of 2023. As a result, the largest 10% of domestic publicly traded companies now represent nearly 75% of the total value of the U.S. stock market, representing the narrowest breadth since the Great Depression.6

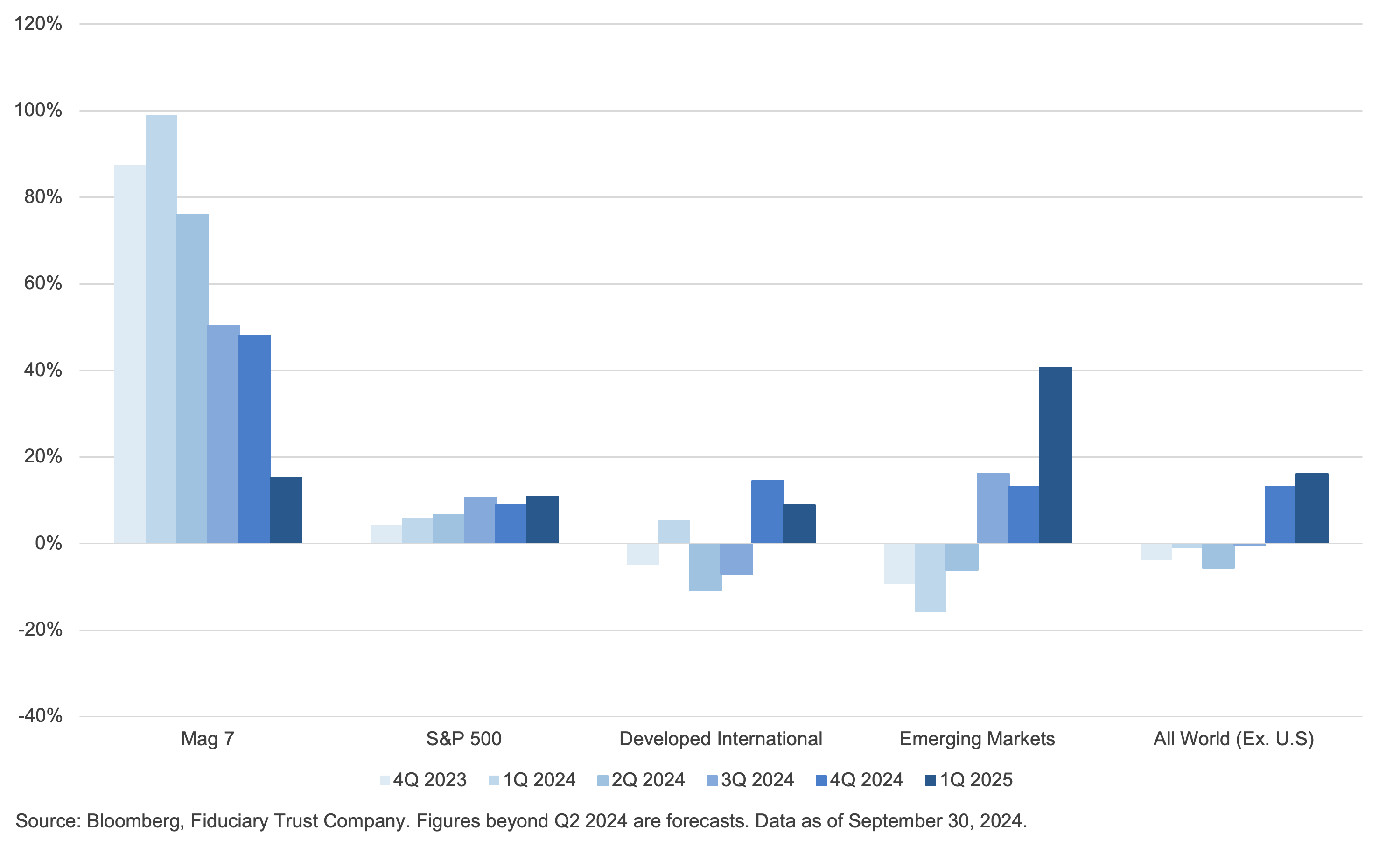

The good news is that earnings and revenue growth are finally starting to broaden out to the 493 other stocks in the S&P 500. In fact, while profit growth for the Magnificent 7 is decelerating, it’s been accelerating for the S&P 493 (Exhibit C). Why is this important? As famed Wall Street observer Bob Farrell has pointed out in his 10 Market Rules to Remember, “the markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names.” By this token, the underlying health of the markets is set to improve, boosted further by an accommodative monetary policy. If revenues and earnings do begin to broaden in a meaningful way, we would expect market returns to follow a similar pattern.

Exhibit C: Earnings Growth by Market

Don’t Expect an October Surprise

Of course, it can be easy to lose sight of the fundamentals in a presidential election year, when anxieties surrounding potential fiscal policy changes tend to swell. Indeed, a survey of global investment managers in September found that the market’s appetite for risk has sunk to a 16-month low, with investors citing concerns over politics and equity valuations as the biggest threats to near-term market returns.7

There’s a reason why the saying is “don’t fight the Fed” and not “don’t fight fiscal policy.” While fiscal policies can affect investments through their long-term impact on the economy, monetary policy changes tend to be met with immediate responses in the stock and bond market. It is also important to remember that investors’ portfolios have been able to flourish under almost every presidential administration in modern history—regardless of Democratic or Republican victory, as we recently pointed out in our paper, “The 2024 Election Is Near: What This Means for Investors.” Since 1932, stocks have averaged double-digit annual returns when the GOP controls the White House, Senate, and House of Representatives as well as when Democrats control both the White House and Congress. Even when Washington faces the potential for gridlock, with one party in charge of the White House and the other controlling Congress, returns have historically been positive.8

To be sure, certain asset classes could be affected by the outcome of the election. For instance, Chinese equities have recently held a strong negative correlation with the likelihood of a Trump victory. But as we previously noted, the market has a knack for surprising investors. Consider that the Biden administration has maintained Trump-era tariffs on China and has further escalated trade tensions by restricting exports on some semiconductors and semiconductor manufacturing equipment to China. In light of this, a Harris victory may not be seen as the boon for Chinese equities that investors appear to be pricing in.

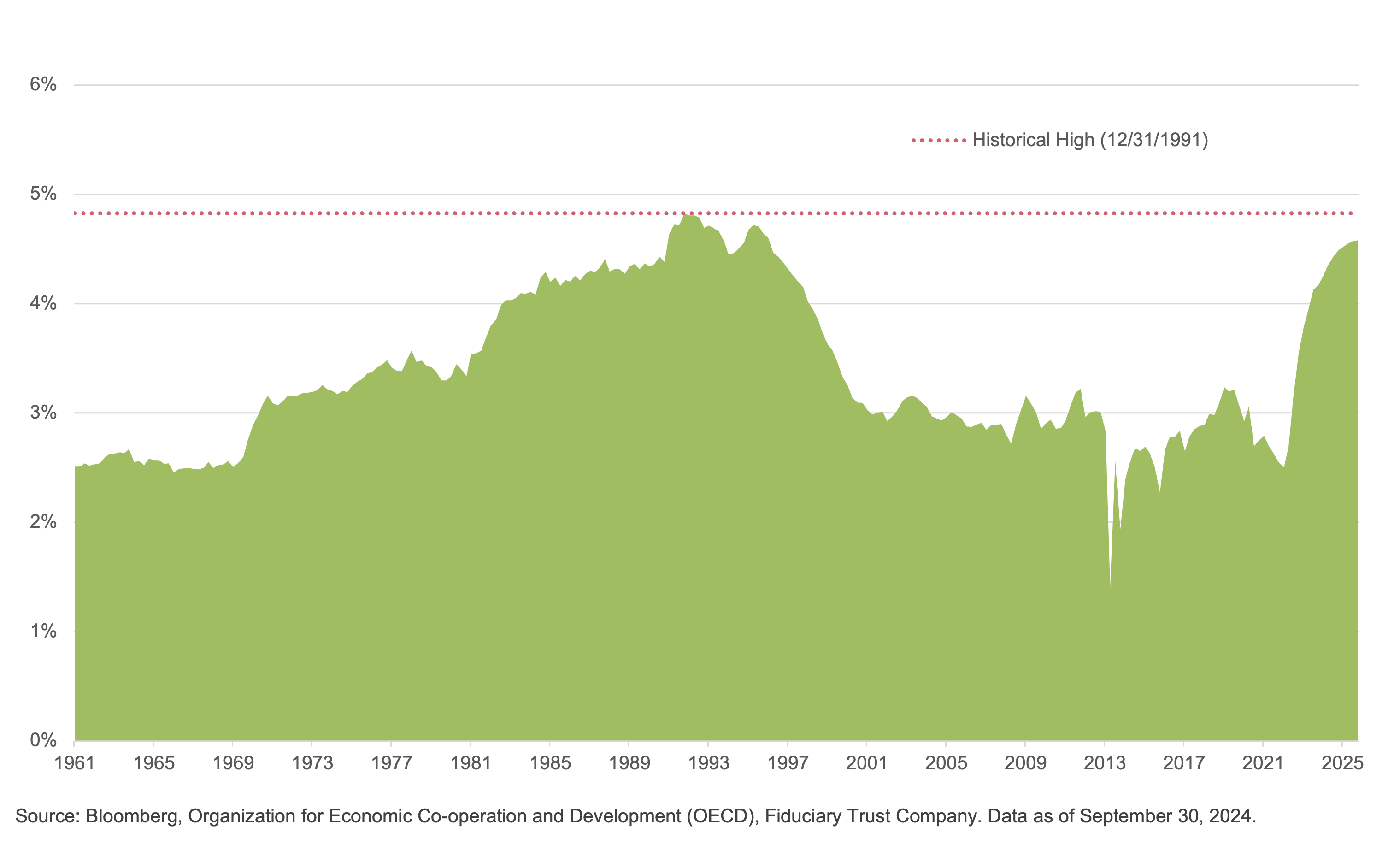

Regardless of who wins the election, the newly elected president will have to figure out how to deal with the ever-expanding deficit. Neither candidate was pressed on the issue during their recent debate. The U.S. debt-to-GDP ratio stands at a whopping 128%, while interest costs on the debt as a percentage of GDP have reached 4.5%, edging out spending on defense (Exhibit D). While that sounds alarming, investors may not recall that interest costs as a percentage of GDP were actually even higher in the mid-1990s, during the aforementioned soft landing. At the end of 1994, debt-to-GDP stood at 64%, about half of where it is today, but interest rates were much higher. The 10-year Treasury hovered near 8%, vs 3.7% today. A combination of the Fed lowering the policy rate and President Clinton presenting a credible plan to rein in the deficit helped bring down long-term rates and engineer a soft landing for the economy and the stock market. Fast forward to today and Fed Chair Powell has started doing his part, but it remains to be seen if whoever is elected president will be able to hold up his or her end of the bargain. Perhaps he/she will be bailed out by strong economic growth if we have an AI-driven productivity boom rivaling the internet-led productivity gains seen in the late ‘90s.

Exhibit D: U.S. Federal Debt Interest Expense Relative to GDP

A Case for an Allocation to International Equities

As interest rates in the U.S. head lower for the time being, the dollar is following them down. The relative strength of the U.S. dollar has played a disproportionate role in the performance of international markets enjoyed by U.S. investors. Fed policy is an important factor in currency prices and ultimately stock returns. To illustrate, U.S.-based investors holding developed market foreign stocks produced annualized returns of just 5.2% (as proxied by the MSCI EAFE Index) over the past decade, compared with the 13% annual gains enjoyed by the S&P 500. However, developed international funds that are currency hedged delivered gains that were nearly identical to the U.S. market. This illustrates the extent to which the dollar’s strength against the euro, pound, and yen has played a major role in the relative returns of domestic versus international stocks in recent years. We recommend investors hold diversified equity portfolios in light of likely changes to currencies going forward.

What’s Ahead for the Markets

It appears that inflation is largely under control while the economy continues to grow. The Federal Reserve Bank of Atlanta’s GDPNow forecasting model currently projects real U.S. economic growth of around 3% in the third quarter, after GDP expanded at the same rate in Q2. This economic growth, combined with the Fed’s launch of its rate cutting cycle, is creating a positive environment for financial markets. We expect the broadening equity appreciation beyond the Magnificent 7 to continue and would not be surprised to see some weakness in the mega cap tech names in the coming months as valuations there are stretched.

We continue to position our portfolios with an overweight to U.S. equities and a neutral allocation to developed international markets. We believe it is also an appropriate time to extend duration in fixed income, although we are positioned with an underweight to the asset class overall. Whether this turns out to be a genuine soft landing or a softish one, a positive backdrop is set for risk assets in our view.

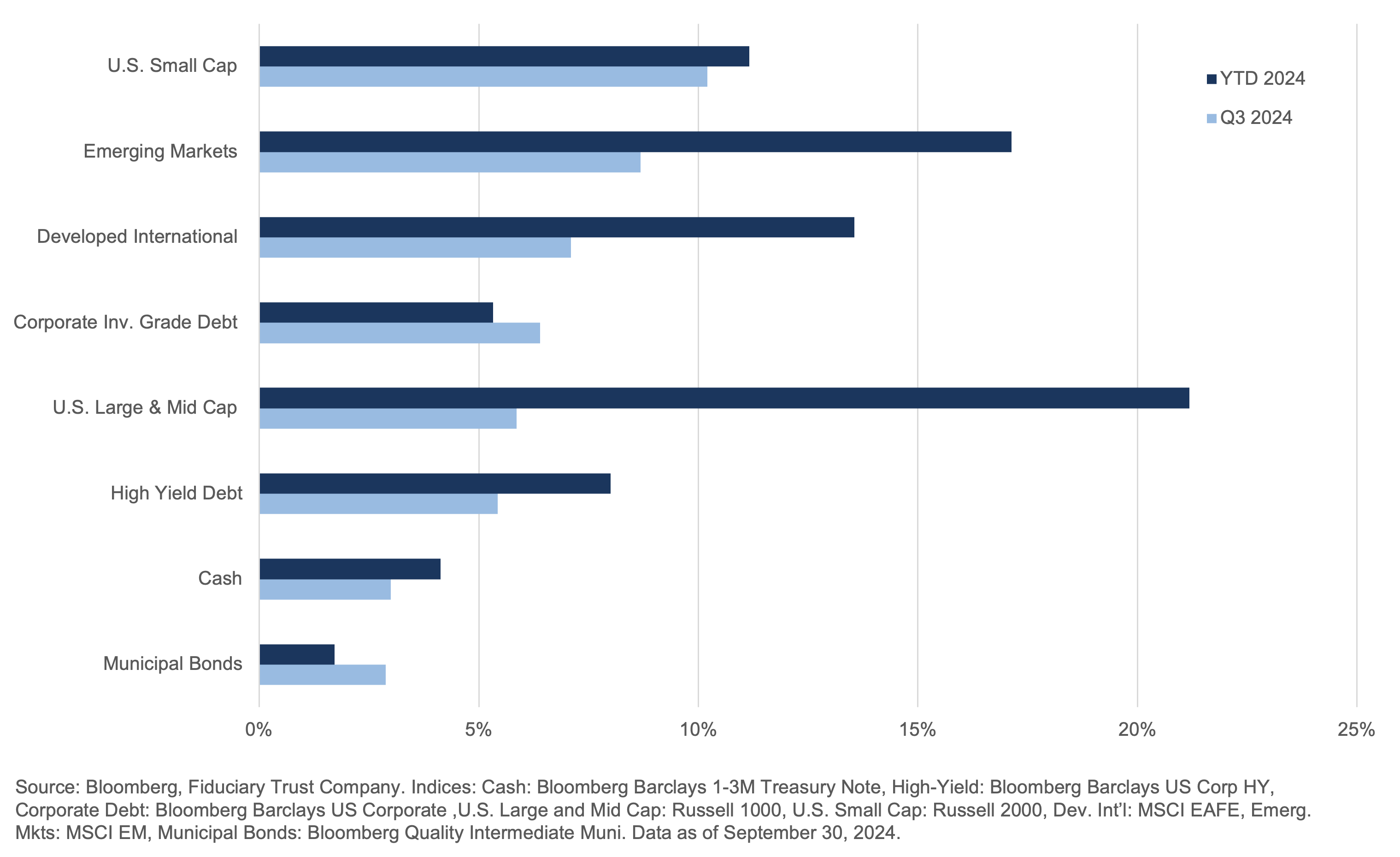

Exhibit E: Total Returns by Asset Class

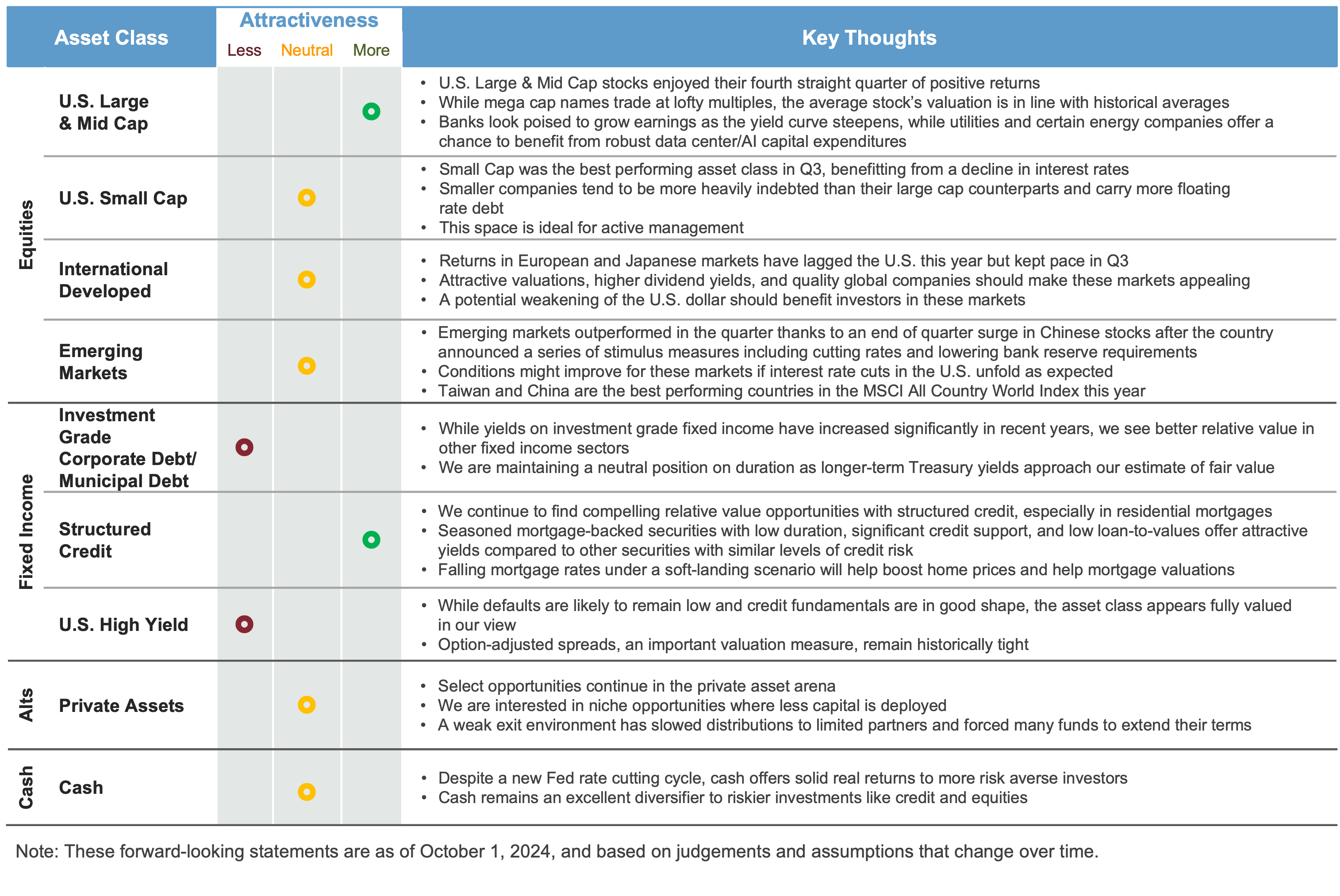

Exhibit F: Fiduciary Trust Asset Class Perspectives

Below is a link to our Fiduciary Perspective, which includes a copy of the Market Outlook.