View our April 16, 2025 Q2 Market Outlook Webinar Replay.

April 1, 2025

If you’ve been having a hard time keeping up with all the policy announcements out of Washington recently, you’re not alone. Since President Trump took office on Jan. 20, new policies, spending cuts, and funding freezes have been pouring out at a frenetic pace. They include: on-again, off-again tariffs against our three biggest trading partners;1 the threat of reciprocal tariffs on all trading partners set to begin early this month;2 sweeping layoffs in the federal workforce led by Elon Musk’s Department of Government Efficiency (DOGE);3 and efforts to freeze federal grants to universities and research centers.4 The White House has also proposed launching a U.S. sovereign wealth fund;5 creating the first-ever U.S. government cryptocurrency reserve;6 and possibly purchasing Greenland7 while seeking to regain control of the Panama Canal.8

Whether many of these actions will actually be implemented has left investors grappling with the implications of these announcements — clearly reflected in recent U.S. equity market declines. In March, the S&P 500 briefly entered correction territory (defined as a 10% drop in value from a recent peak) while the Russell 2000 index of small cap stocks nearly slipped into a bear market (representing a 20% decline from a recent peak).

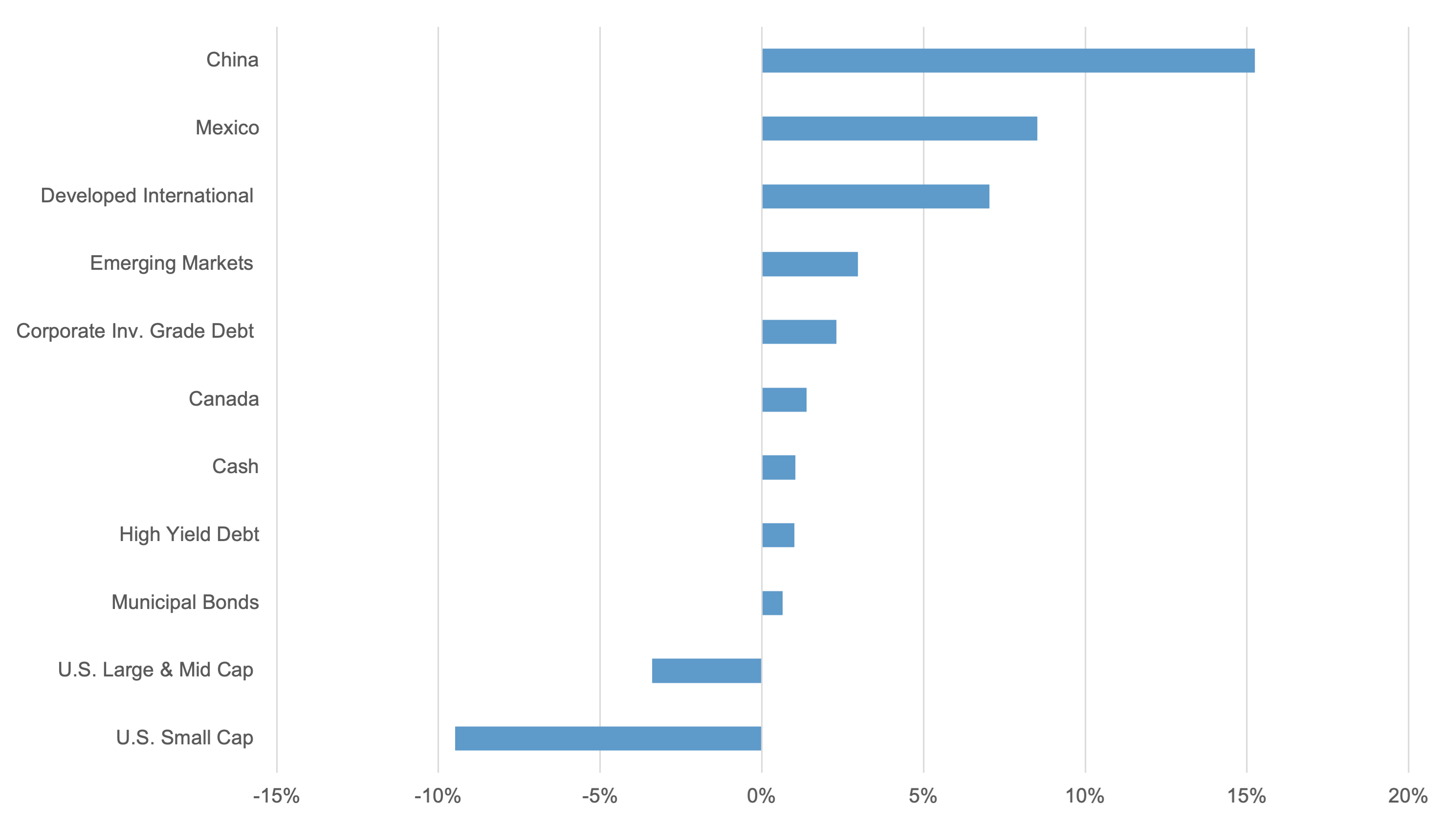

The reaction of non-U.S. equity markets to the prospect of increased U.S. tariff rates has been surprising. Given that the U.S. economy is less dependent on international trade compared to many other countries — meaning imports and exports make up a smaller percentage of GDP — conventional wisdom held that tariffs would have a greater negative impact on non-U.S. economies. While that ultimately may prove to be the case, non-U.S. equities have experienced strong gains so far this year. Particularly noteworthy are Chinese equities which have been among the best-performing markets despite China being the primary focus of U.S. tariffs.

Exhibit A: Total Returns by Asset Class, Q1 2025

Source: Bloomberg, Fiduciary Trust Company. Indices: Cash: Bloomberg Barclays 1-3M Treasury Note, High-Yield: Bloomberg Barclays US Corp HY, Corporate Debt: Bloomberg Barclays US Corporate, U.S. Large and Mid Cap: Russell 1000, U.S. Small Cap: Russell 2000, Dev. Int’l: MSCI EAFE, Emerg. Mkts: MSCI EM, Municipal Bonds: Bloomberg Quality Intermediate Muni; China: MSCI China Index; Canada: MSCI Canada Index; Mexico: MSCI Mexico Index. Data as of March 31, 2025.

Interpreting Trump’s Economic Actions

The flurry of news out of Washington, D.C., has led many to wonder about the underlying objectives of these proposals and whether there is a coherent economic strategy guiding decisions that sometimes appear random or spontaneous. We, like many, don’t know the ultimate plan, but a technical 41-page document titled “A User’s Guide to Restructuring the Global Trading System” by economist Stephen Miran offers insights. At the time of drafting, Miran was a senior strategist at Hudson Bay Capital Management. Today, he is Chairman of the White House Council of Economic Advisors, making him one of the President’s closest advisors on U.S. economic and trade policy matters.

Miran’s paper articulates where tariff policies might ultimately settle and sheds light on how other recent proposals from the Trump administration, such as establishing a sovereign wealth fund, may be interconnected. Our primary focus here is to try to anticipate what economic policies may be proposed and then analyze their implications for capital markets, rather than comment on the merits and drawbacks of the tariff policy itself.

In his paper, Miran argues that many challenges facing the U.S. economy stem from the overvaluation of the U.S. dollar relative to other currencies. He posits that the strong dollar has been driven not only by the special role the greenback plays in international finance as the world’s reserve currency, but also by America’s unique role in providing a “security umbrella” to its allies. A strong dollar makes U.S. exports less competitive, meaning it is cheaper for the U.S. to import goods rather than manufacture them domestically. Miran argues that persistent trade deficits have contracted the U.S. manufacturing base, jeopardizing the U.S.’ ability to meet our security commitments to our allies (e.g., manufacture defense systems). To address this, Miran suggests that tariffs could be used for multiple purposes: negotiating leverage, raising revenue, or helping protect critical domestic manufacturing. While Miran’s perspectives are in contrast to other established economists, given he is currently in the Trump administration, investors can use his framework to try to understand and potentially differentiate between tariff announcements that are likely to become permanent policies and those serving as negotiating tactics intended to secure concessions from other countries. For example, tariffs on products identified as critical for national security, such as steel, are more likely to be permanent.

Miran’s paper covers much more than tariffs. Notably, Miran articulated a scenario in his November paper that closely resembles recent Trump administration developments: “Suppose the U.S. levels tariffs on NATO partners and threatens to weaken its NATO joint defense obligations if it is hit with retaliatory tariffs. If Europe retaliates but dramatically boosts its own defense expenditures and capabilities, alleviating the United States’ burden for global security and threatening less overextension of our capabilities, it will have accomplished several goals. Europe taking a greater role in its own defense allows the U.S. to concentrate more on China, which is a far greater economic and national security threat to America than Russia is, while generating revenues.”

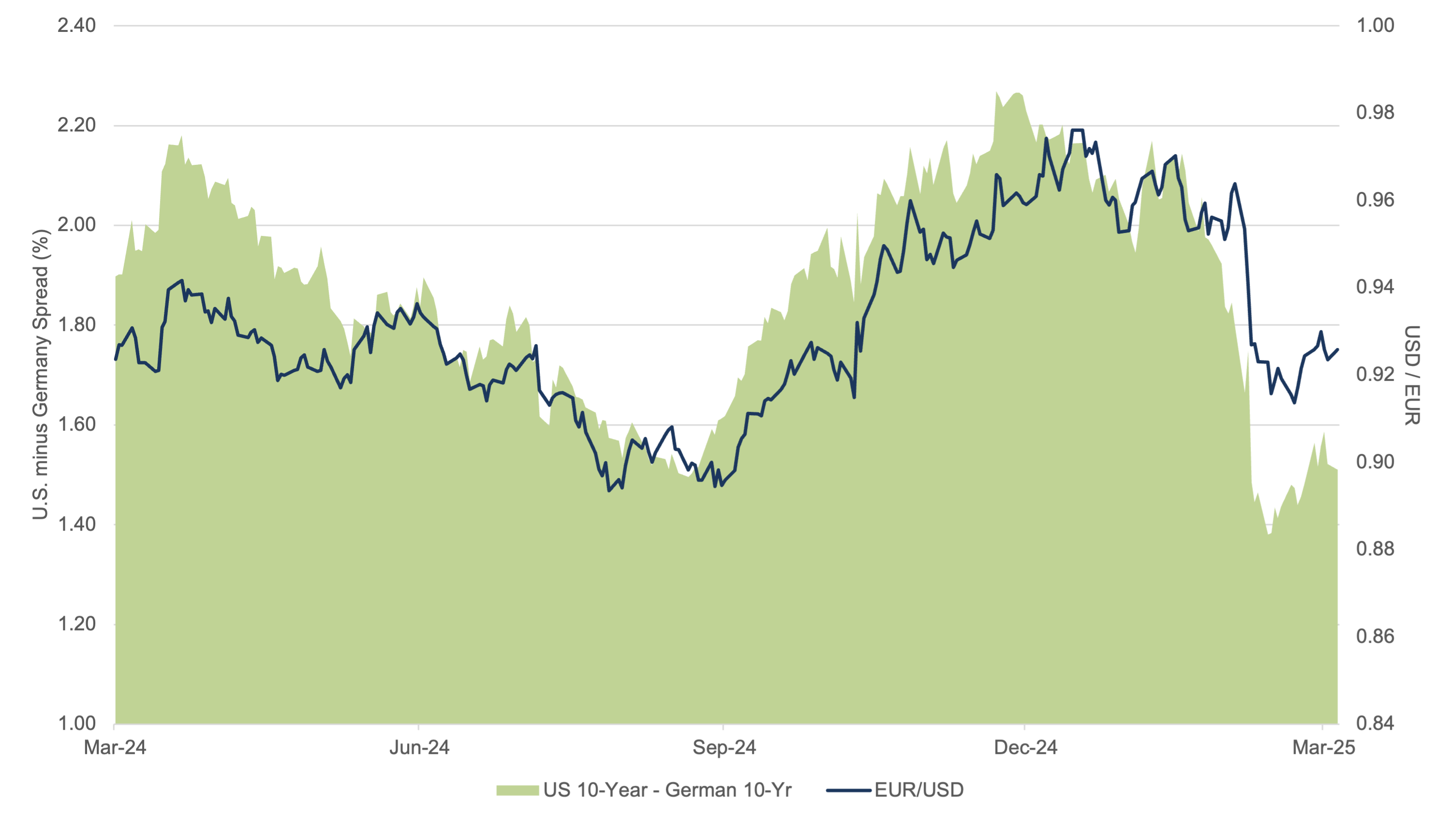

We have already seen this play out, with Germany and other European nations vowing to accelerate defense expenditures amid President Trump’s current stance toward NATO. Miran’s paper suggests that Europe paying for its own defense will reduce U.S. defense spending, leading to a lower deficit, reduced U.S. Treasury bond issuance, and therefore lower interest rates in the U.S. and a weaker dollar. In fact, the market reaction to Germany’s announcement on defense spending is helping fuel upward revisions to forecasts for European growth and productivity, as well as higher interest rates in Germany.9 And that, in turn, has helped strengthen the euro against the U.S. dollar in recent weeks. While this narrow economic analysis aligns with Miran’s thesis in the near term, the larger issues of global security and cooperation with allies have been challenging and will likely have longer-term implications on global markets.

Exhibit B: U.S. Minus Germany Real 10-Year Gov’t Bond Yields vs. USD/EUR

Source: Bloomberg, U.S. Bureau of Labor Statistics (BLS), European Central Bank (ECB), Fiduciary Trust Company. Real yields are calculated using Germany’s Harmonized Index of Consumer Pricing (HICP) year-over-year data and the U.S. Consumer Price Index (CPI). Data as of March 31, 2025.

Assessing the Impact of Tariffs

Like with many things, it’s important to develop a base case scenario for the economic impact of future events, like tariffs, which can then be adjusted if actual policies differ from expectations. Conveniently, Miran’s paper is quite clear on what he thinks—and possibly the Trump administration thinks—the optimal level of tariffs should be. Miran suggests the optimal average tariff rate for the U.S. is about 20%. That assumes no retaliatory tariffs, so the optimal rate would decrease if other countries respond with retaliatory tariffs. If one assumes that other countries respond 1-for-1 then the optimal tariff rate would be about 10%. For context, the current effective U.S. tariff rate today stands at approximately 2.4%.

Recent developments indicate that countries targeted by the Trump administration’s tariffs will indeed impose retaliatory measures. Therefore, a potential base case for investors to consider would be a 10% average tariff rate on U.S. imports along with reciprocal tariffs on U.S. exports. Prominent economic research organizations, including the Yale Budget Lab and the Peterson Institute, have modeled scenarios involving a 10% universal tariff on U.S. imports, both with and without retaliation.10 11 Not surprisingly, their forecasts indicate potential reductions in U.S. real GDP ranging from -0.4% to -0.9% over the next year. While these estimates are concerning, the U.S. would nevertheless still be forecasted to deliver positive real GDP growth despite the tariffs.

Projecting the impact of tariffs on corporate earnings is perhaps even more challenging. In addition to the level of tariffs, investors need to consider currency movements, competitive dynamics and pricing power, and the extent of companies’ international operations and supplier networks. Strategas Research has conducted significant analysis on this topic and estimates that depending on the extent of tariffs implemented, S&P 500 earnings growth this year could range between 3.9% and 8.5%. This represents a deceleration from the current consensus of roughly 10% year-over-year growth. Additionally, it is likely that equity prices have already begun to reflect some of these anticipated impacts as reflected in the decline in U.S. equities since the inauguration.

An Upward Revision in Uncertainty

Even if one has a reasonable estimate of the ultimate level of tariffs, significant uncertainty remains about when these tariffs will be finalized. Investors have noted April 2nd as the date when President Trump is expected to announce any reciprocal, sector-specific, or global tariffs. However, it’s possible that the administration decides to delay or modify these tariff decisions, as has happened multiple times already. The longer the tariff decisions remain uncertain, the longer consumers and businesses will be in a holding pattern, unwilling to commit to significant new purchases, investments, or hires.12 This could amplify the economic impacts beyond the direct effects of the tariffs themselves.

As one transportation equipment maker reported in the February 2025 Manufacturing ISM Report on Business, “Customers are pausing on new orders as a result of uncertainty regarding tariffs. There is no clear direction from the administration on how they will be implemented, so it’s harder to project how they will affect business.”13 A respondent to the Dallas Fed quarterly energy survey put it more bluntly, saying “I have never felt more uncertainty about our business in my entire 40-plus-year career.”

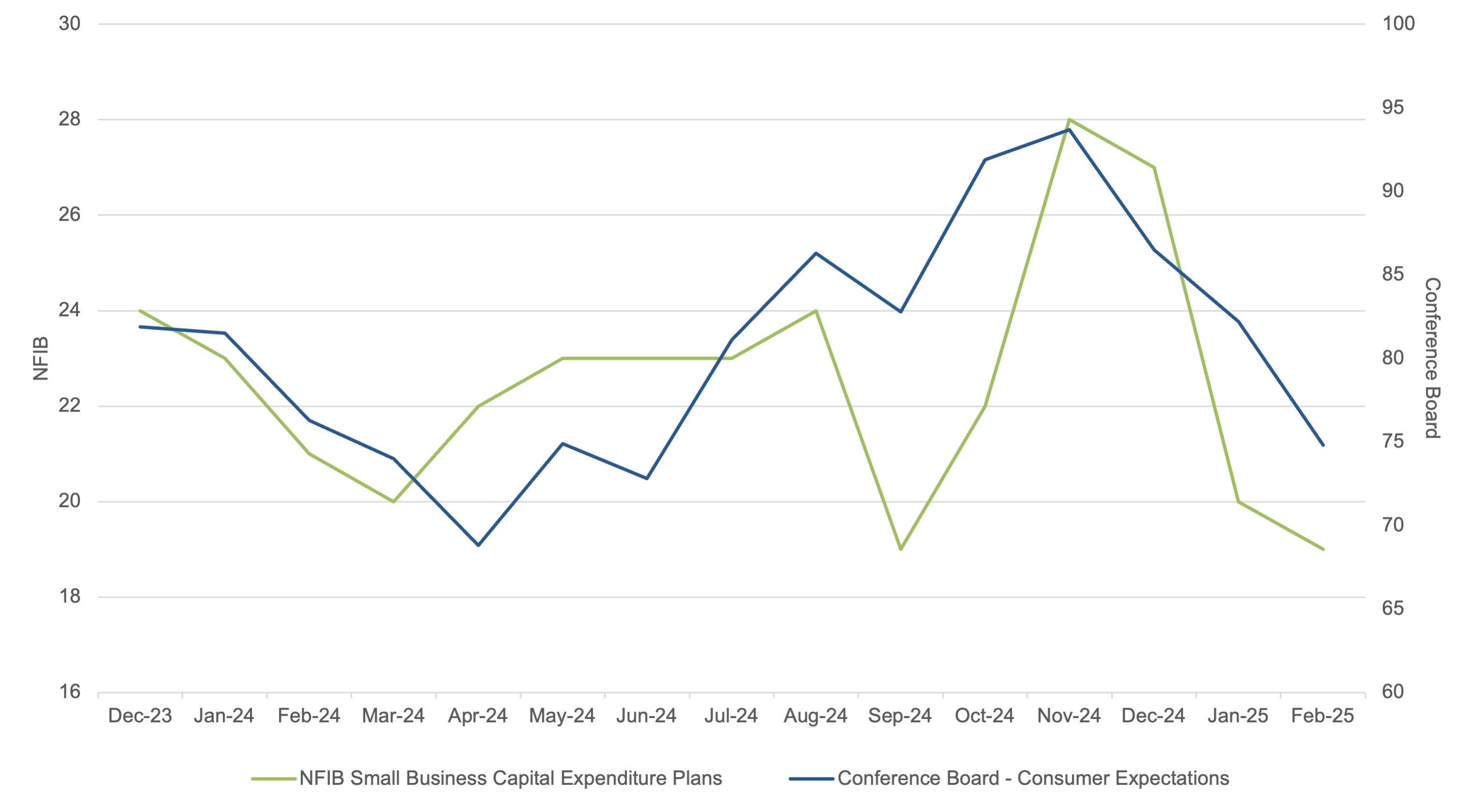

These statements mark a reversal from the more optimistic tone amongst some businesses and consumers after the election in November. The National Federation of Independent Business (NFIB) Survey from November showed a surge in the number of small businesses planning to increase capital spending in the near term. The latest survey data from February shows capital spending plans have plummeted, with just 19% of small businesses expecting to increase capital spending in the next six months. We’ve seen a similar pattern play out on the consumer side. The Conference Board’s Consumer Confidence – Expectations Index is now lower than it was prior to the election. The Index is constructed from survey data based on consumers’ assessment of the outlook for income, business, and labor market conditions.

Exhibit C: Small Business Capital Expenditure Plans vs. Consumer Expectations

Source: Bloomberg, National Federation of Independent Business (NFIB), Conference Board, Fiduciary Trust Company. Data as of March 31, 2025.

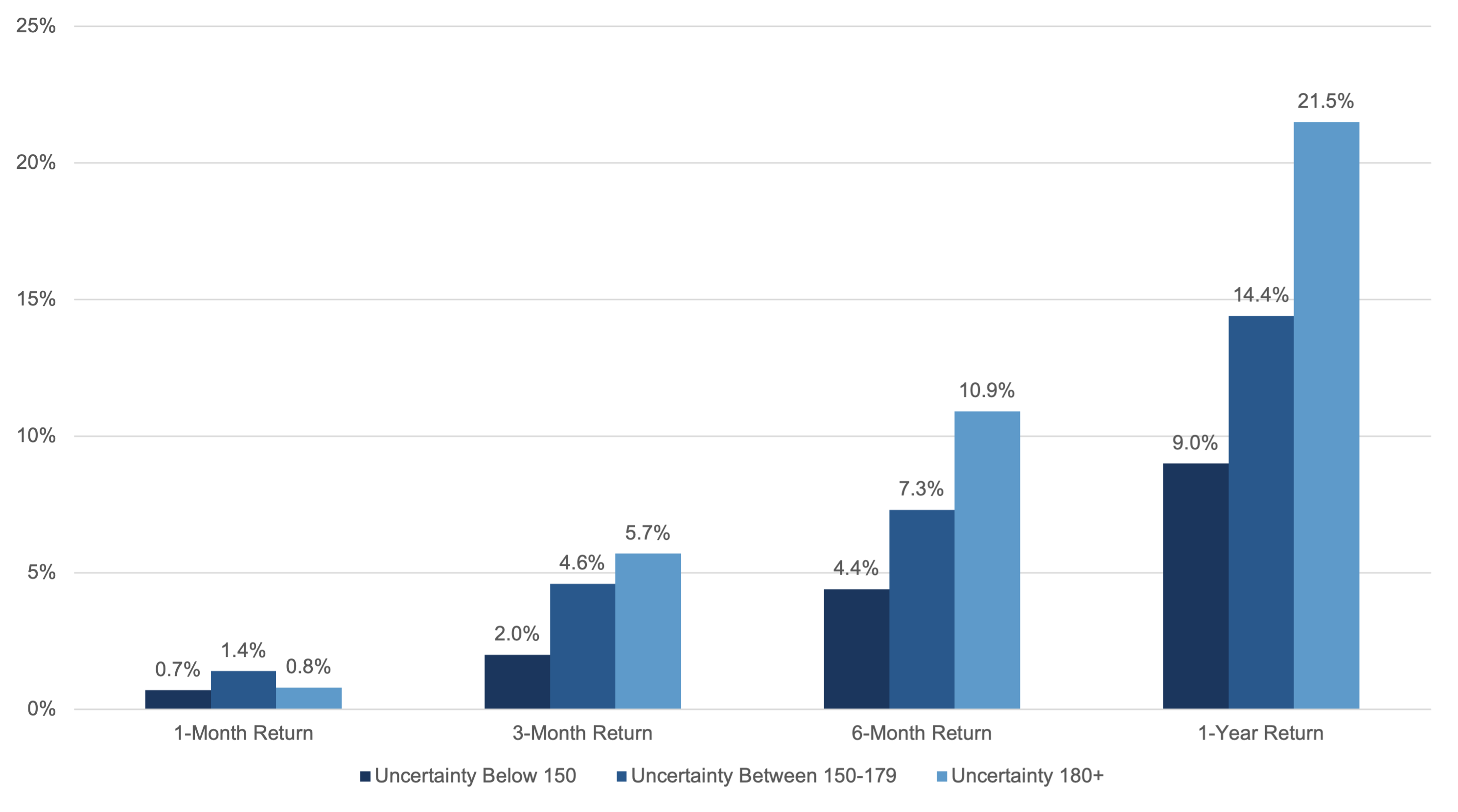

As prognosticators try to predict what is to come, there’s even an index dedicated to quantifying the level of economic uncertainty — the U.S. Economic Policy Uncertainty Index (Uncertainty Index). This index attempts to measure the degree of uncertainty in the economy by tracking how frequently terms related to economic uncertainty appear in leading newspapers, monitoring temporary federal tax code provisions, and analyzing the degree of disagreement among economic forecasters. Unsurprisingly, this index is near all-time highs today. However, this does not necessarily indicate trouble for equity markets. In fact, periods of elevated uncertainty have often been followed by strong equity market performance.

Since 1985, whenever the Uncertainty Index has climbed to a level of 180 or higher, the S&P 500 has returned 21.5%, on average, over the subsequent 12 months. By comparison, U.S. stocks have gained 9% per year when the Uncertainty Index fell to 150 or lower, according to Strategas Research. To put this in context, the Uncertainty Index stood at 483 on March 21.

Exhibit D: Average S&P 500 Returns Following Spikes in U.S. Policy Uncertainty

Source: Bloomberg, Strategas, Baker, Bloom, and Davis, Fiduciary Trust Company. Note: This index attempts to measure the degree of uncertainty by tracking how frequently terms related to economic uncertainty appear in leading newspapers, monitoring temporary federal tax code provisions, and analyzing the degree of disagreement among economic forecasters. Data as of March 31, 2025.

This is not to say we expect such lofty gains for U.S. stocks over the coming year, or that tariffs will have no negative impacts on businesses and consumers. However, businesses and the overall economy tend to be more resilient than often perceived. Once tariff policies are finalized, businesses will be better positioned to make capital spending plans and offer clearer guidance to investors. Also, a major contributor to the elevated Uncertainty Index shown above is tax policy uncertainty related to the approaching expiration of the 2017 Tax Cuts and Jobs Act. Finalizing tariffs one way or the other will facilitate the revenue projections that will be a factor in ongoing tax legislation.

The Economy & Markets

While tariffs and uncertainty will likely weigh on economic growth in the near-term, a recession still appears unlikely this year. Household balance sheets in aggregate are in good shape, the labor market is cooling, but still strong by historical standards, and government spending is still likely to be strong. Most economists, including those at the Federal Reserve, agree that the U.S. will avoid recession. At its March meeting, the Fed released a new series of economic projections, and while it lowered its forecast for U.S. GDP growth this year, it projects that the economy will grow 1.7% in 2025 and 1.8% in 2026.14

Speaking of the Fed, it’s important to remember that should GDP growth or the labor market begin to slow meaningfully, monetary policy remains a potential backstop. The Fed has room to cut heading into the next slowdown, with the Federal Funds Rate upper bound currently set at 4.5%. The central bank’s so-called “dot plot,” which plots where each member of the Federal Open Market Committee anticipates the Federal Funds rate will be headed going forward, shows expectations for two rate cuts this year and two more in 2026.15

To be sure, if slowing growth is accompanied by rising inflation, that could complicate the Fed’s efforts to lower rates. However, another positive development for rates is the Fed’s decision to slow the pace of quantitative tightening by shrinking its balance sheet at a more gradual rate starting in April. Instead of allowing $25 billion in Treasuries to mature without being reinvested, the Fed will reduce that to just $5 billion.16

Outlook and Portfolio Positioning

If tariff deliberations drag on longer than expected or the average tariff rates differ from current forecasts, one will need to make portfolio changes accordingly. But, while we await more clarity on the policy front, there are several things we continue to feel confident about in 2025. Among them:

- Capital Expenditure spending on artificial intelligence should remain robust and AI will likely boost long-term productivity. In the first quarter, Alphabet, Amazon, Apple, Meta, and Microsoft all publicly reconfirmed their commitments to boosting capital expenditures, each promising $65 billion to $100 billion in new investments this year, largely going toward building out their AI infrastructure or capabilities. AI continues to advance rapidly, and intense competition in the sector is likely to lower costs for users while boosting long-term productivity gains for the broader economy.

- Investors can earn attractive yields in fixed income. Investors seeking to reduce exposure to equity market volatility can find yields in excess of 6% in select segments of the fixed income market, which in our view, offer minimal interest rate sensitivity and low credit risk.

- Banks are less directly impacted by tariffs and may benefit from this administration. We think it’s very likely that changes will be made to bank capital ratio rules that will allow banks to expand lending and/or increase stock buybacks, both of which should increase earnings. Additionally, as service-based businesses, banks are relatively immune from tariffs.

- Diversification has worked. As noted earlier, while the S&P 500 and Russell 2000 Indexes are in negative territory year-to-date, Developed International and Emerging Market equities have posted strong returns. All major fixed income sectors including municipal bonds, U.S. Treasuries, and Investment Grade and High Yield Corporate bonds have delivered positive returns.

While policy turmoil has understandably occupied investor attention, especially given its immediate impact on markets, it’s essential to remember that there are many factors affecting the global economic landscape. As a result, trying to anticipate some of these policies and actively monitoring near-, medium-, and longer-term implications may provide a more stable path forward for investors.

If you have questions about investing your portfolio during these times of uncertainty and beyond, please contact your Fiduciary Trust Investment Officer.

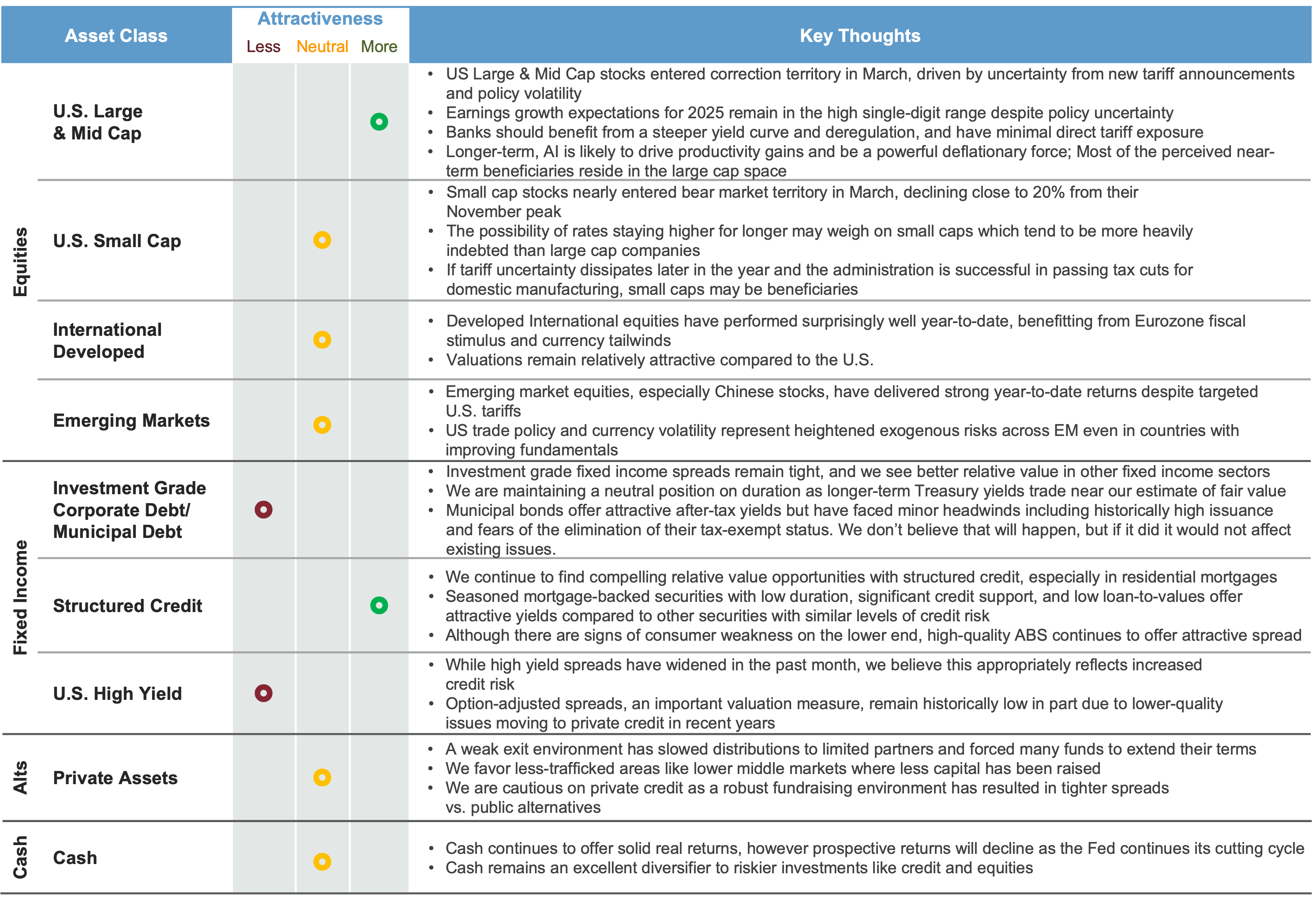

Exhibit E: Fiduciary Trust Asset Class Perspectives

Note: These forward-looking statements are as of April 1, 2025, and based on judgements and assumptions that change over time.