Selecting the right wealth advisor is an important decision that can have a profound impact on your ability to achieve your personal and financial goals. It is important to find an advisor with whom you are comfortable, and it is equally important to be well informed and thoughtful about the firm you choose. To help with this process, we have identified several key criteria we recommend you consider when choosing an advisory firm and advisor. We have also included some questions to ask potential advisors so you can better understand what they have to offer and foresee possible shortcomings.

Selecting the Right Wealth Management Firm

When selecting an advisor, it is important to find an experienced individual who can meet your needs and with whom you feel comfortable working. However, if the person is not at a firm that has the alignment of interests, breadth of capabilities, depth of expertise, and time horizon that you require, the value that an individual advisor can deliver is likely to be limited. Therefore, we believe it is important to consider the following four factors when evaluating wealth management firms:

1. Clients’ Best Interests

According to Spectrem Group’s research, investors cite trustworthiness as the most important factor in selecting an advisor. While we expect most advisors in the industry are well intentioned, the reality is that many have incentives that may cause them to recommend investments that do not align with their clients’ best interests.

For example, many advisory firms receive payments from the fund companies in which they invest your assets, and these fund managers may pay for events and educational seminars for advisors in an attempt to influence them.1 This may cause an advisor to favor one fund manager or type of fund over another, even to their clients’ detriment.

In addition, many investors do not realize that there is a range of standards with which investment managers may be legally obligated to comply. While broker/dealers, registered investment advisors, and trust companies may provide similar investment services — such as managing your retirement savings — they are bound to different standards of impartiality under federal and state law:

- The Securities & Exchange Commission considers broker/dealers to be salespeople, while investment advisors and trust companies are considered “advisors.” Further complicating matters, some broker/dealers use potentially confusing titles such as “financial advisor” when highlighting their wealth planning services even while they are not being governed by the same standard as an investment advisor or trust company. Under federal and state law, broker/dealers are only required to make recommendations that are suitable for their clients. This means that a broker/dealer can legally recommend a product which may not be the best option for you — and for which they may receive compensation from the investment provider — so long as it is merely “suitable.” This can potentially result in lower returns due to investments having higher fees, and higher taxes due to investments with higher turnover and taxable distributions.

- A “fiduciary,” such as a firm operating under a trust charter, like Fiduciary Trust, or a registered investment advisor (RIA), is held to a higher standard under which it must always put a client’s interest above its own. The firm must have your best interests in mind and its incentives must be aligned with yours. Some fiduciaries do have proprietary investment products (such as pooled investment vehicles), however, that may not be focused on your best interests and may limit your flexibility to move your assets to another firm in the future should you be dissatisfied.

Key Questions to Ask:

- Does your firm receive compensation from third-party fund managers?

- Do you sell proprietary products, and if so, how are you compensated for selling them? How do you ensure that they are the best products for your clients? Could these investments be moved to another firm without selling them and triggering capital gains taxes?

- Does your firm adhere to the fiduciary standard in all of its services?

At Fiduciary Trust, we have been focused on our clients’ best interests for over 135 years, and we adhere to the fiduciary standard. We do not receive compensation from third-party investment managers for directing investments to their funds and do not manage proprietary investment products, allowing us to avoid conflicts of interest in this area.

2. Breadth and Expertise

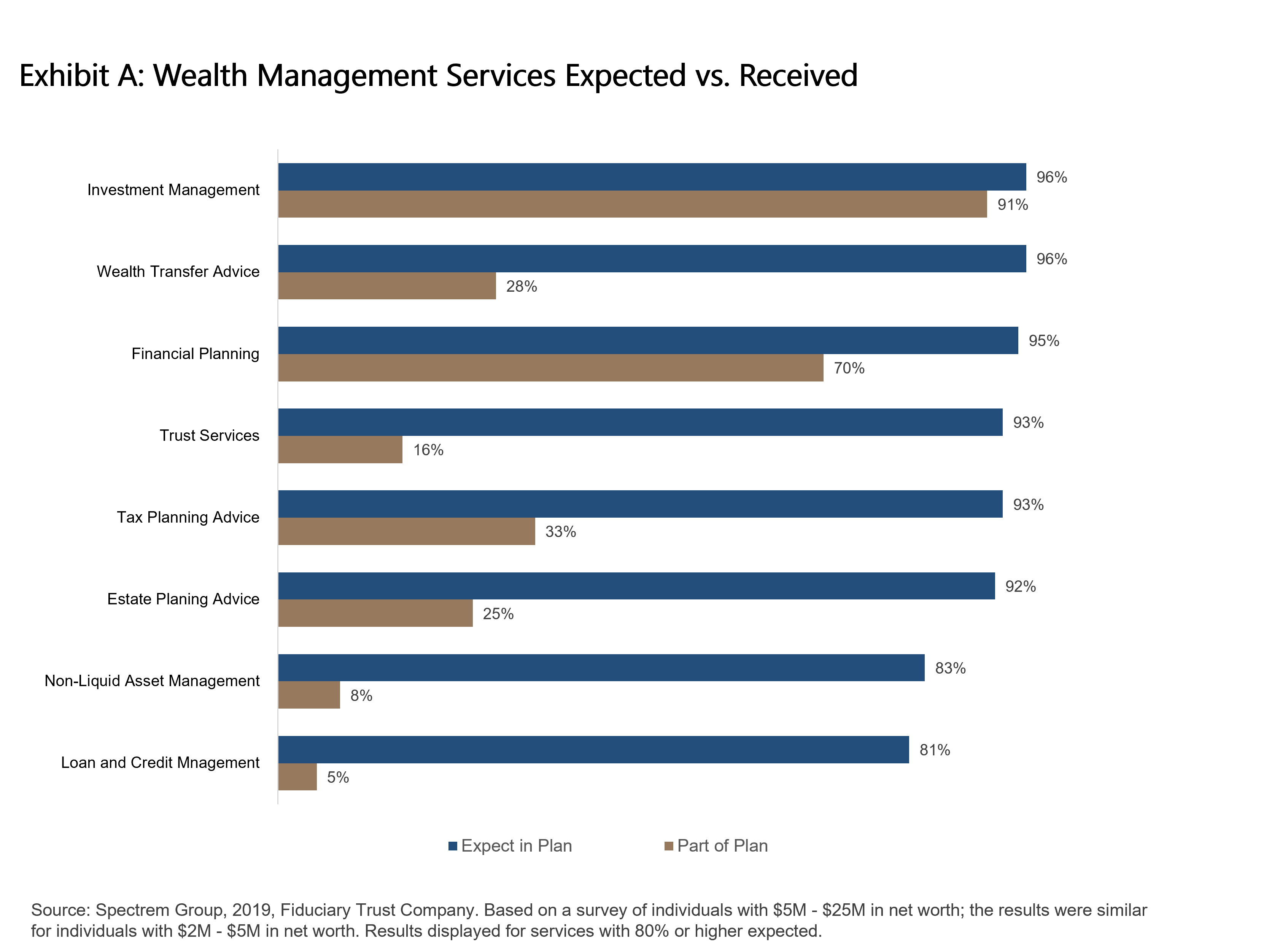

According to Spectrem Group, while wealth managers typically provide two of the key services that high-net-worth families seek (investment management and financial planning), few are providing the broader range of services they desire, as described in the chart below:

In addition to needing this range of services, many clients appreciate the convenience of obtaining advice on these areas from their wealth advisor in order to allow for better integration of planning and execution. This is likely to result in a more robust and complete plan and ultimately, better results.

While having access to the breadth of necessary services is desirable, it is equally important that the firm have experience and expertise in these services. Firms with dedicated teams of professionals in the service areas that are important to you will be best positioned to serve your needs. Look for professional credentials, such as Chartered Financial Analyst® (for investment managers), Certified Financial Planner® or related planning credentials, trust and estate attorneys, Certified Public Accountants, and Certified Trust Financial Advisors. In addition, it is important for the firm to have a bench of talent in those key areas so you are not reliant on just a couple of individuals without the sufficient support to deliver robust services.

Key Questions to Ask or Research on a Firm’s Website:

- What type of services does your firm offer beyond investment management and financial planning? These may include:

- Wealth transfer and estate planning advice

- Trust and estate services

- Tax services

- Insurance Advice

- Loan and credit services

- Access to non-liquid assets (such as private equity)

- How deep is your firm’s expertise in these services?

- How long have you been providing each service?

- Do you have dedicated teams in each of these areas? How many professionals do you have in each area?

- What are the credentials of people in each of these areas?

- Has your firm received industry recognition for any of these services?

At Fiduciary Trust, we have teams of experts in wealth planning (including financial, tax, and estate planning), wealth transfer, trusts, investment management and lending, donor-advised funds, and other programs.

Learn More: Fiduciary Trust’s Services and Awards

3. Personal Service, Customization, and Flexibility

Finding a firm and advisor that tailors their approach to your needs can have a significant impact on your satisfaction when interacting with your advisor, and on their ability to help you best achieve your goals. Customization can help ensure that a client’s portfolio is best suited to her tax situation, long-term goals, and any other individual wealth-planning needs. Some firms push clients into standard model portfolios due to their large size and challenges managing complexity, limiting the ability to optimize around the needs of specific clients. Some smaller firms also pursue this approach and are unable to customize their plans because of inadequate resources and expertise.

It is also important for an advisor to respond to clients in a timely manner and with the depth of information required in a given situation. This both helps ease a client’s mind if she has a concern, and integrates the advisor into the client’s financial decision-making process for choices that affect her overall wealth plan. When a client seeks professional advice early and from an advisor who understands their entire financial picture, they are likely to see better results.

Key Questions to Ask:

- Will my assets be invested in a standard portfolio? To what degree can my investments be customized?

- How will you minimize my capital gains, income, and estate taxes?

- Do you offer sustainable investing strategies (if that is of interest)?

- How quickly can I expect you to respond when I reach out with questions about my investments or other matters?

- Will I have online and mobile access to my account information and investments?

At Fiduciary Trust, a highly experienced and dedicated investment officer serves each of our clients. Our investment officers take the time to understand our clients’ personal and financial needs in detail. This ensures that we create a customized set of solutions, backed by our expert teams, to help meet their needs today and across generations.

Learn More: Fiduciary Trust’s Investment Philosophy and Sustainable and Impact Investing

4. Permanence

While it is easy to focus on one’s current needs, it is equally important to consider the various and often unpredictable ways in which the future may unfold. Some firms are built around a few individuals who own the majority of the company. Their retirement, separation, or incapacity can often cause an upheaval in client service and firm stability. Ideally, an advisory firm has an ownership structure in place that continually attracts talent and provides an ongoing transfer of ownership so the firm can remain independent and free from disruption.

Key Questions to Ask:

- Who owns your firm? How much of the ownership is concentrated in the top few individuals? (You can find this information for RIAs in their publicly available Form ADV.)

- What is your firm’s plan for transitioning ownership when the major shareholders retire?

- Has the firm experienced a transition of ownership before? If so, how was it managed?

- If you were to retire or leave the firm, with whom would I work at the firm?

At Fiduciary Trust, we are built for permanence, as demonstrated by our longevity, our diverse set of shareholders, and our broad ownership structure.

These factors all enable the ongoing attraction and retention of talent.

Learn More: What Makes Fiduciary Trust Distinctive?

Selecting the Right Individual Wealth Advisor

In addition to finding the right wealth management firm, it is also important to work with an individual advisor who has the skills and working style that fit your needs:

1. Wealth Management Skills

If you have substantial wealth or complex needs, it is important to seek a primary advisor with experience managing significant assets. While it is rare and often unnecessary to find an individual with deep expertise in all your areas of need, your advisor should have substantial knowledge in these areas. Importantly, your advisor should know what questions to ask and when to connect you with experts in particular domains, such as estate or tax planning.

Key Questions to Ask:

- What is your work and educational background?

- For how long have you been serving clients with similar needs to mine?

At Fiduciary Trust, we pair our clients with our knowledgeable professionals, who have an average of more than 20 years of experience. Our professionals also have extensive training in a range of wealth management areas and are supported by teams of experts in the specific areas previously mentioned.

Learn More: The Fiduciary Trust Team

2. Working Style

While wealth management skills are more about the technical capabilities of an advisor, “working style” refers to the way an advisor interacts with clients, including their communication approach and interpersonal skills, and is often influenced by their personal values. It is easy to both under- or overestimate the importance of working style. If you focus on style without adequate attention to an individual’s skill or firm, you risk selecting someone with whom you are personally compatible, but who is not fully capable of meeting your needs. However, if you ignore style in the selection process, you risk finding an advisor with deep expertise, but in whom you are uncomfortable confiding.

In seeking someone who has a style that is a good fit, it is important to consider what you want in an advisor and the nature and frequency of your interactions with that person. Some people’s wealth management needs are intertwined with complex, non-financial family dynamics or challenges, such as special needs family members, family members who do not get along, or chronic illness. These individuals will be more likely to need an advisor who displays significant empathy and is interested in understanding family issues and helping clients navigate through them. Other clients may be more interested in the investment process, and seek an advisor who will spend more time going into specific investment decisions, offering regular updates and rationale. No matter what your specific case is, it is critical to find an individual you can trust.

Key Questions to Ask

- What led you to become an advisor? What do you enjoy most about your role? What do you enjoy least?

- What would you see as the agenda for our regular meetings and how much time would you envision our spending on each area?

- What are your interests outside of work?

At Fiduciary Trust, we recognize that clients have different working style needs and preferences. As a result, we have a team of experienced professionals with a range of styles. In some cases, our prospective clients meet with two or three of our advisors so they can determine which one is the best fit.

Next Steps

By identifying your range of needs and asking some of the probing questions above, you will be well positioned to select a wealth management firm and advisor who will benefit you and your family for many years to come.

We invite you to reach out to discuss your needs and goals with one of our experienced professionals. They will take a personal approach to your situation based on expertise, strong performance, and a genuine commitment to act in your best interest.

For more information, please contact Sid Queler at queler@fiduciary-trust.com or 617-292-6799.