There is a common misconception that donor-advised funds are for donors with smaller balances to devote to charitable causes, while foundations are for larger scale gifts. It is accurate that donor-advised funds (DAFs) are more economical for smaller balances, but they can also be attractive for large gifts. In fact, there are individual DAF accounts in the industry with balances well over $100 million.

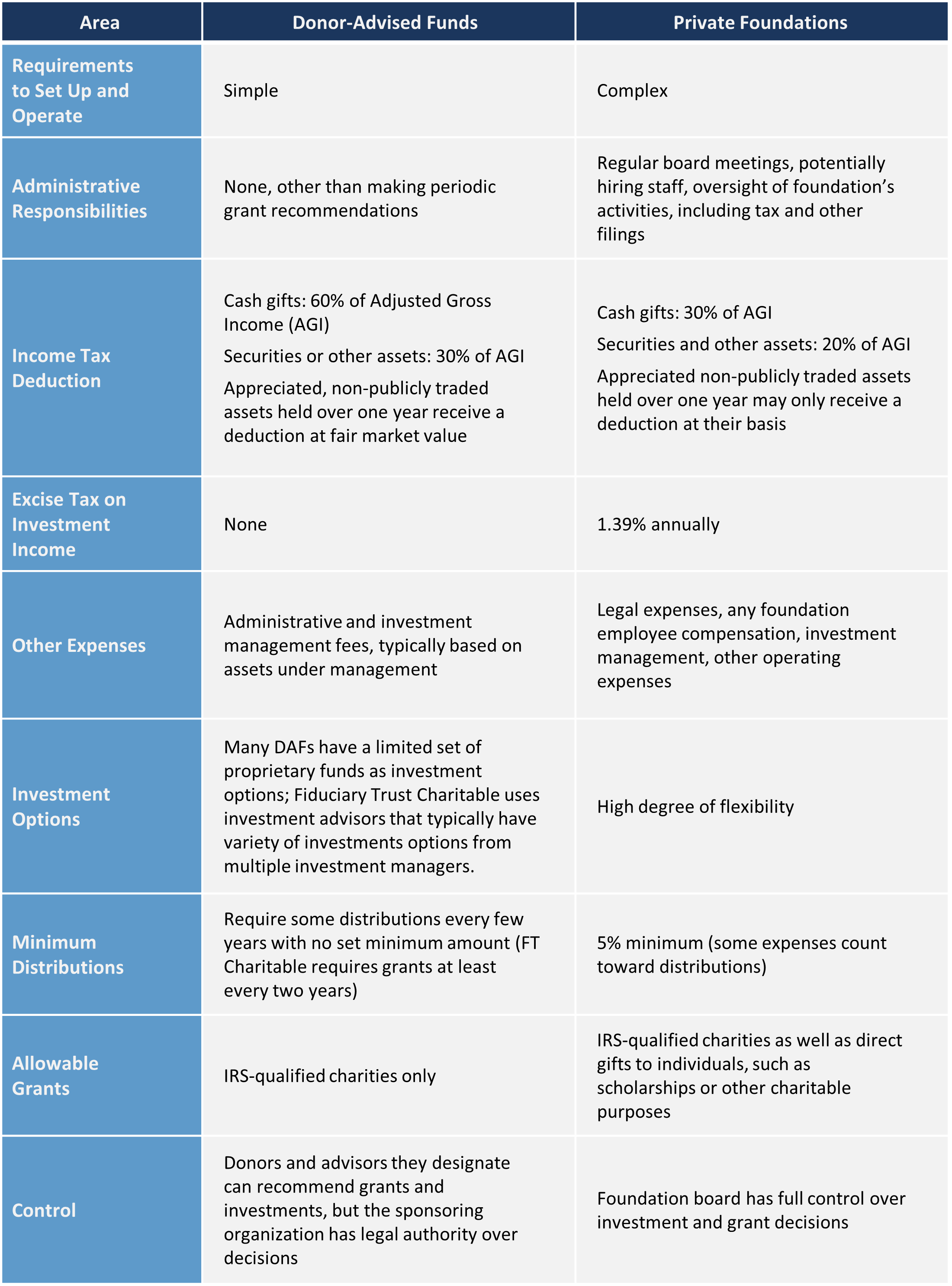

So how should a donor decide whether to establish a private foundation or a donor-advised fund? If the donor only wants to make grants to IRS-qualified charities, a donor-advised fund is typically the better vehicle, due to its cost and tax efficiency, as well as other factors. However, if the donor wants to hire a staff or make grants to individuals, such as scholarships, a foundation is necessary, but also typically much more expensive . The table below summarizes the key differences between donor-advised funds and private foundations.

Donor-advised funds can also be used in conjunction with private foundations. For example, if a private foundation is challenged to meet its 5% annual distribution requirement, it can make a gift to a donor-advised fund to meet its requirement. In addition to donor-advised funds and private foundations, there are other vehicles for charitable giving, such as charitable remainder trusts.

Learn More: A Perfect Pair: Private Foundations and Donor-Advised Funds

Consult your Fiduciary Trust Company officer for information about the various alternatives.

Primary Differences Between Donor-Advised Funds and Private Foundations

Published September 2017, Updated August 2020