Donating non-publicly traded, illiquid assets to a donor-advised fund can be an effective way to increase your charitable impact. A well known charitable giving strategy involves contributing public company stock with a low tax basis to a donor-advised fund (DAF) and then gifting the proceeds to charities over time. This strategy entitles the donor to a charitable income tax deduction for the DAF contribution while avoiding the realization of embedded capital gains. Donors may not be aware, however, that this strategy can also be used to contribute a range of illiquid or complex assets to DAFs.

The ability to use a donor-advised fund to receive a range of illiquid, non-publicly traded assets provides an important opportunity for donors to enhance their charitable impact and potentially decrease their tax liability. While the most common DAF contributions are cash and publicly traded securities, these are far from the only options.

- Examples of complex assets that may be contributed to a DAF include restricted stock, real estate, cryptocurrency, hedge fund interests, and private company stock. It is worth noting that most public charities are unequipped or unable to accept these types of complex assets directly.

- Donors are not taxed on capital gains for contributed assets and typically receive a federal income tax deduction of up to 30% of adjusted gross income for contributions. Unused deductions can be carried forward and used for up to five years.

- Contributions of illiquid assets to donor-advised funds generally receive more favorable tax treatment than gifts to private foundations. (Learn More: Donor-Advised Fund or Private Foundation?)

- While gifting can be a straightforward process with the right partner, such as Fiduciary Trust Company, it is important to follow specific gifting and substantiation rules to ensure maximum tax deductibility.

What Types of Assets Can Be Contributed?

Donors may contribute a wide range of assets to a donor-advised fund that has a program and expertise to accept them. Examples include:

- Private Business Interests: Private company stock and other ownership interests in privately owned or closely held businesses

- Real Estate: Residential, commercial, farmland, timber, and other types of real property

- Restricted Public Company Stock: Shares owned by individuals, such as key insiders, that are restricted by the company for sale for a period of time

- Private Funds: Hedge funds, private equity, venture capital, and other types of investment limited partnerships, and other fund types

- Life Insurance: Cash value policies which are typically fully funded

- Cryptocurrency: Bitcoin, Ethereum, and other cryptocurrencies

- Tangible Personal Property: Paintings, sculptures, jewelry, collectibles, rare item collections

- Other Illiquid Assets: Donors have contributed a wide range of other assets to donor-advised funds, even items as specialized as railroad cars

What Are the Benefits of Contributing Illiquid Assets?

There are four key benefits that donors often seek when gifting complex, illiquid assets to charity:

- Increase the funds available to benefit charitable causes

-

Obtain an income tax deduction (subject to adjusted gross income limits) based on the gift’s fair market value for most assets, provided the donor owned the asset for more than a year. Also, donors are not taxed on capital gains when an asset is sold in the DAF.

- Rebalance the donor’s investment and/or asset portfolio without triggering taxable gains

- Offload responsibility for the sale of an asset

What Are Key Considerations?

It is important to work with advisors who are knowledgeable in the logistics and tax implications of donating these gift types to charity. Although considerations will vary depending on the nature of the gift, some key factors that donors should keep in mind include:

- Generally, donors should consider contributing assets with a low cost basis that have been held for at least one year.

- The asset cannot be close to being sold or the IRS may consider it a “pre-arranged sale,” in which case the donor may be liable for a taxable gain upon the sale.

- The donor-advised fund sponsor must complete appropriate due diligence to determine whether it will accept the gift. Also, any controlling organization, such as a hedge fund manager, must be willing to transfer ownership to the DAF sponsor.

- For assets that are intended to be sold soon after receipt by the DAF sponsor (which is usually the case), there must be a concrete plan for marketability and sale.

- The donor is responsible for obtaining a qualified appraisal and filing appropriate IRS forms (including Form 8283). The appraisal must occur within 60 days of the effective date of the gift and must be received by the donor before the due date of the federal tax return on which the charitable deduction is claimed.

- The donor may not continue to use or benefit from the property once it has been donated.

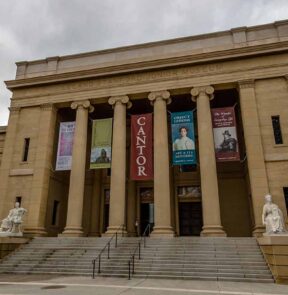

- Although the charitable deduction for art, collectibles, and other tangible property is based on the lower of cost basis or fair market value when contributed to a DAF, a larger deduction may be available if these items are gifted to a public charity that can use the asset in its normal operations for its tax-exempt purpose (for example, gifting artwork to a fine art museum).

- The charitable deductions for property created by the donor and life insurance policies are also limited to cost basis.

- Donations of partial interests in assets or restricted assets may receive a valuation discount for tax deduction purposes.

How Can Fiduciary Trust Help?

Fiduciary has been helping clients achieve their philanthropic goals through a variety of charitable giving strategies for over a century. We also partner with a network of experts to help you benefit from specialized knowledge when contributing illiquid assets.

We are honored to have been recognized with multiple industry awards for our services, including the Best Philanthropic Offering Award by WealthBriefing.

Reach out to discuss how we can help you achieve your charitable goals.