Competition among investment advisors for high-net-worth clients has never been more intense. Successful advisors know that investment returns, while important, are only one part of the equation when catering to wealthy individuals and families. Wealthy clients demand that their investment advisors offer more than investment management services. They want a holistic approach to the management of their wealth that combines investment management with financial, tax, and estate planning. They also want the ability to offer trust services as part of a comprehensive solution for managing wealth today and planning for the transfer of wealth to future generations.

While these services have become increasingly essential to high-net-worth clients, few investment advisors are able to offer these capabilities internally and only a select minority have built the necessary network of relationships to offer a coordinated solution with external partners. Many investment advisors recognize the importance of trusts, but they may lack the necessary experience to serve as trustee. Many advisors also lack the desire to take on the fiduciary liability associated with serving as trustee, preferring instead to focus on their core competency, which is normally investment management and/or financial planning. For these advisors, an external partner who specializes in trust administration can be an important ally in addressing the needs of current clients and in attracting new ones.

Selecting a Trust Services Partner

Selecting the best trust company with which to partner is no small task. Choosing an advisor-friendly trust company that will work with you and not compete against you can be even more challenging. When selecting a trust partner, investment advisors should look for the following essential qualities:

- Experience administering trusts and serving as trustee

- The ability to offer directed trust services where the trust company handles the administration of the trust (and in many cases custody), while letting you focus on managing the investments held in the trust

- Internal trust, tax, and legal professionals that are available as resources

- The ability to provide trust and tax accounting and reporting for a variety of trust assets

- A demonstrated track record of successfully partnering with external advisors

- The ability to offer access to a state (situs) with favorable trust and tax laws

Accessing Favorable Trust Environments

While all of these qualities are critical in selecting a trustworthy financial partner, the ability to offer access to states with progressive trust and tax laws has become an increasingly important planning consideration for high-net worth clients. As mentioned earlier, not all states are created equally when it comes to trust law. Some states, like New Hampshire, have actively engaged in modernizing their trust laws and have come to be recognized as preferred jurisdictions for establishing and administering trusts. The benefits of establishing a trust, for example, that is governed by New Hampshire law include the following:

- Directed Trusts

- New Hampshire law allows for investment and administrative responsibilities to be clearly divided among trustees and investment advisors.

- State Income Tax Savings

- There are no state capital gains or income taxes in New Hampshire on irrevocable trusts that meet certain criteria.

- Asset Protection Trusts

- New Hampshire law allows for the creation of trusts that protect assets against claims from the settlor’s and/or beneficiary’s creditors.

- Dynasty Trusts

- While most states require that a trust terminate within a certain time frame mandated by statute, New Hampshire law allows an individual to establish a perpetual or “dynasty” trust.

- Sustainable Investing

- New Hampshire became one of the first states to allow trustees to pursue a sustainable investing strategy, regardless of investment performance, at the express direction of all persons interested in the trust.

- Flexibility

- New Hampshire law allows for decanting, a process of distributing assets from an old trust to a new trust with more favorable administrative provisions, and the use of non-judicial settlements to resolve trust disputes.

- Dedicated Trust Court

- When a court proceeding is necessary, New Hampshire has a dedicated trust court with judges who are highly experienced in trust law, which can accelerate decision making and improve outcomes.

The advantages of New Hampshire trust laws can be accessed by residents of all states as long as their trust is administered in New Hampshire by a New Hampshire-based trustee. For more information on the New Hampshire trust advantage, please go to fiduciary-trust.com/nh-trusts.

Creating an Effective Partnership

With the right trust company partner, your position as a center of influence for your clients is significantly enhanced. You do not have to be an expert in all the technical details of trusts. But, your role as a trusted advisor is strengthened by recognizing and suggesting the use of trusts, while letting the trust company handle the details of establishing and administering the trust. Once the trust is established, the trust company can function largely behind the scenes, letting you continue to focus on the management of the assets held in the trust.

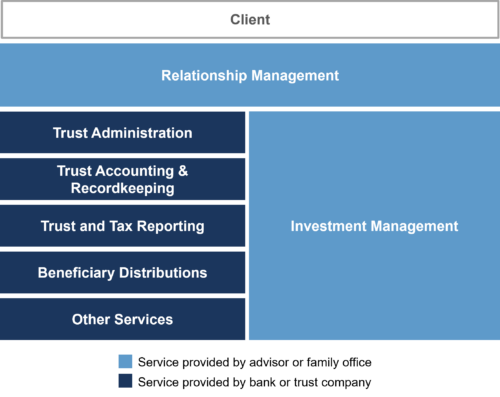

The exhibit below illustrates the potential roles of an advisor and a trust company in serving a family with a “directed trust” arrangement which is available through trust companies operating in a few states, such as New Hampshire.

Exhibit A: Advisor and Trust Company Roles

With only about 10% of investment advisors currently offering trust capabilities, your ability to offer trust services provides a significant competitive advantage that can help you retain existing clients and grow your business. Fiduciary Trust Company of New England is a New Hampshire chartered trust company. Together with our Massachusetts affiliate, Fiduciary Trust Company, we have been successfully partnering with external advisors to provide directed and delegated trust services and/or custody for more than 50 years. We currently have relationships with over 100 registered investment advisors and family offices representing over $12 billion in client assets.

For more information on Fiduciary Trust’s directed trust, custody and other services for RIAs and Family Offices, visit www.Fiduciary-Trust.com/For-Advisors or contact Michael Costa at (603) 695-4321 / mcosta@fiduciary-trust.com .