The foundation of successful investing requires a disciplined process managed by experienced professionals who are focused on their clients’ best interests. Our approach is built around a set of fundamental beliefs that guide our investment decisions.

Fiduciary Trust is a global allocator of investment capital across a broad set of asset classes. We employ a deliberate process when making investment decisions in order to invest in opportunities that we believe will exceed targeted returns. We undertake this process while maintaining awareness of behavioral biases, market efficiencies, tax liabilities, and client-specific preferences and needs.

Our Investment Beliefs

Our core investment beliefs provide a foundation that guides our investment process and decisions. They are as follows:

1. The goal of investing is to preserve and grow purchasing power

Investment success is not about what you make, but what you keep. Consequently, we not only strive to avoid permanent loss of capital and be tax efficient, but most importantly, we strive to exceed each client’s risk/return targets. We believe this is best achieved through careful construction of a client’s portfolio to maximize the potential return they might achieve relative to portfolio risk.

Organizing an investment program around longer-term, strategic, asset allocation raises the odds of realizing competitive returns. However, it is also important to adapt to short-term conditions. Therefore, we continuously evaluate the stream of opportunities that markets and economies create, and change portfolio posture tactically to enhance portfolio returns.

Strategic Asset Allocation

A long-term investment strategy can help investors avoid market timing pitfalls. As illustrated by Exhibit A, historically over longer time periods, the level of downside risk diminishes considerably. For investors who have “stayed the course” over five or 10 years, the potential for strong performance has been high, and with it the likelihood of significant losses has been low. Our proprietary capital market assumptions are used to establish strategic asset allocation “beacons” which seek to optimize the tradeoff between expected returns and downside risk. They also serve as guideposts for clients.

Tactical Asset Allocation

While strategic asset allocation is a critical driver of long-term returns, there is also a role for tactical (shorter-to-intermediate-term) investment decisions, especially when valuations of certain asset classes are at extremes. Exhibit B illustrates this point. Over the past 25 years, when the S&P 500 has been trading at a high price-to-expected earnings multiple, the index has experienced zero to negative returns over the subsequent five years.

At the other end of the spectrum, when the index has been priced at low multiples, index returns have been strong over the subsequent five years. Hence, there has historically been an opportunity to enhance investment performance through tactical asset allocation adjustments when valuations are at extremes or when we have other insights that can inform allocation adjustments.

3. Broader investment opportunities improve outcomes

The investment landscape is without boundaries. Therefore, our portfolio construction approach is global, short- and long-term, active and passive, and public and private, where appropriate. We also incorporate Environmental, Social, and Governance (ESG) factors into our evaluation of all investment opportunities.

Learn More: Sustainable and Impact Investing: From Ideas to Action

Additionally, we believe in the importance of diversification within each asset class, which reduces volatility, while maintaining attractive return characteristics.

Exhibit C illustrates the benefits of a large investment universe, as the top performing asset classes vary considerably from year to year. With a narrower investment universe, investment opportunities are significantly limited. Moreover, use of a broader set of investments in an optimized portfolio can also dampen volatility, which produces better risk-adjusted returns.

Being deliberate about where to employ active vs. passive investing strategies is also a key element of our strategy. Given that the opportunity set available to active management varies across asset classes, we seek to avoid active managers where the opportunity for alpha (outperforming a market benchmark) is low. Where it seems unlikely that a manager can outperform his or her benchmark after fees, we invest in passive, low-cost vehicles to gain efficient market exposure. Conversely, in markets that hold the promise to realize alpha, we will use active managers. Our open architecture format enables us to employ this blended approach, which we believe serves investors more favorably than a one-size-fits-all strategy.

Being deliberate about where to employ active vs. passive investing strategies is also a key element of our strategy. Given that the opportunity set available to active management varies across asset classes, we seek to avoid active managers where the opportunity for alpha (outperforming a market benchmark) is low. Where it seems unlikely that a manager can outperform his or her benchmark after fees, we invest in passive, low-cost vehicles to gain efficient market exposure. Conversely, in markets that hold the promise to realize alpha, we will use active managers. Our open architecture format enables us to employ this blended approach, which we believe serves investors more favorably than a one-size-fits-all strategy.

Learn More: The Roles for Active and Passive Investments

Additionally, in the business of wealth management, the practice of advisory firms receiving compensation from proprietary investment products or incentives from third-party investment managers is common. This approach creates misaligned incentives. At Fiduciary Trust, we do not accept compensation from third-party investment providers for directing assets to their funds, nor do we have proprietary investment vehicles. This eliminates real and perceived conflicts of interest, keeping us firmly on the same side of the table as our clients.

4. Behavioral biases hinder effective decision-making

Behavioral biases, such as loss aversion, overconfidence, and herding can significantly reduce an investor’s performance. Industry studies have estimated that over a market cycle, the typical self-directed investor’s returns are reduced by 1.5 to 3.0 percentage points annually due to myriad behavior biases.1

We strive to counter these behavioral tendencies that are common to all investors and impede success. We do this through rigorous analytical decision-making and timely execution, as described below.

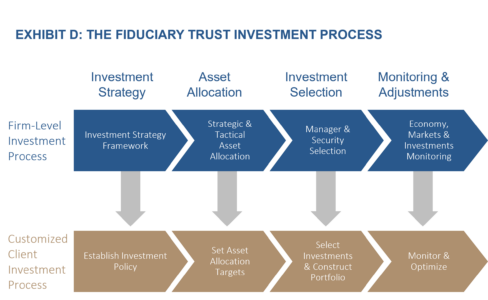

Given our decades-long experience, working with clients to develop an investment program that is transparent, repeatable, and disciplined is core to the value we bring to the relationship. In so doing, we leverage Fiduciary’s fundamental investment beliefs to implement a two-pronged portfolio construction process designed to combine the best firm-level thinking with client-specific circumstances and preferences.

This process is led by our Chief Investment Officer and supported by our investment professionals. This includes teams focused on macro economic analysis, manager selection & due diligence, securities analysis, and portfolio solutions. Each client is served by a dedicated Investment Officer who manages the client relationship and ensures investment solutions are appropriately customized for their specific needs.

The Firm-Level Investment Process

Our firm-level investment process is focused on determining the optimal investment portfolio “beacons” and investment securities to meet a range of client needs. While it is represented as a linear process in Exhibit D, it is actually a continual, iterative process as new information is incorporated to enhance our views and recommendations. The Investment Policy Framework represents our investment beliefs, discussed earlier, that guide our decisions. Next in the process, we establish a range of long-term, strategic asset allocation targets based on expected market returns over a business cycle for a variety of differentiated asset classes. Tactical asset allocation adjustments are incorporated based on business cycle and market dislocation factors. These tactical deviations are employed to reflect return- enhancing opportunities and/or to mitigate outsized risks that are an enduring part of investing.

With the asset allocation guidance in place, we conduct detailed due diligence to identify and maintain a recommended list of investment options. We also continuously monitor the global economy, global markets, as well as specific market sectors to help create successful outcomes.

The Client Investment Customization Process

Clients come to Fiduciary with unique missions, circumstances, and objectives. Therefore, one of the primary elements of our portfolio construction process is to create fit-for-purpose solutions that reflect the distinct requirements of each client. A dedicated Investment Officer works with each client to establish and manage a customized investment portfolio, leveraging guidance from our Investment Team.

Our client-specific process begins with the establishment of a personalized investment policy, which often incorporates inputs from a client’s wealth plan. This includes an understanding of personal and financial goals, as well as current assets and unrealized taxable gains, investment vehicle and security preferences, and risk tolerance. Based on this personal information, and leveraging our capital market assumptions, we determine the appropriate strategic asset allocation as well as the appropriate securities for a client’s portfolio. For clients with taxable accounts, we are careful to evaluate the tax impact of potential portfolio adjustments before implementing investment changes.

Learn More: Wealth Planning: Is Your Financial House in Order?

On an ongoing basis, we rebalance client portfolios to help ensure they remain aligned to their targets. We also continuously monitor client portfolio performance and modify investments as appropriate based on investment outlook changes, expected manager performance, the potential to reduce taxes through tax-loss harvesting, and other factors. Throughout this process, we continuously communicate with our clients, both through conversations with their Investment Officer and by providing access to insights from our Chief Investment Officer and broader Investment Team.

Through employing a thoughtful investment process focused on our clients’ best interests and managed by experienced professionals, we help clients achieve their personal and financial goals.