If you don’t believe that demographic forces can have a powerful impact on the economy and markets, just consider Japan. A generation ago, Japan was viewed as the biggest threat to U.S. dominance in the global economy — that is, until the 1990s, when the world’s largest market based on stock capitalization at the time began to show its age.1

By 1993, the country’s birthrate had fallen to fewer than 10 births per 1000 people, nearly half the level of the early 1970s, and the country was well on its way to becoming the oldest population in the world.2 The nation’s shrinking pool of workers combined with its burgeoning ranks of retirees contributed to an economic slowdown that has persisted for more than 40 years, with GDP consistently growing at an annual pace of 2% or less since the early 1990s.3

Fast forward to today, and China, which is now viewed as the biggest threat to U.S. dominance in the global economy, is showing its age too. China finds itself where Japan was a quarter century ago, with its birthrate this year down to 10 per 1000 people, nearly half its pace in the early 1990s.4 Today, 12% of China’s population is now 65 or older and by 2050 that figure is projected to grow to 26%.5 Meanwhile, economic growth in China has fallen to less than 5%,6 down from more than 7% a decade ago and 14% in 2007.7

How the Aging Population Affects the Economy

It’s not just China and Japan; the whole world is getting older as global birth rates fall.

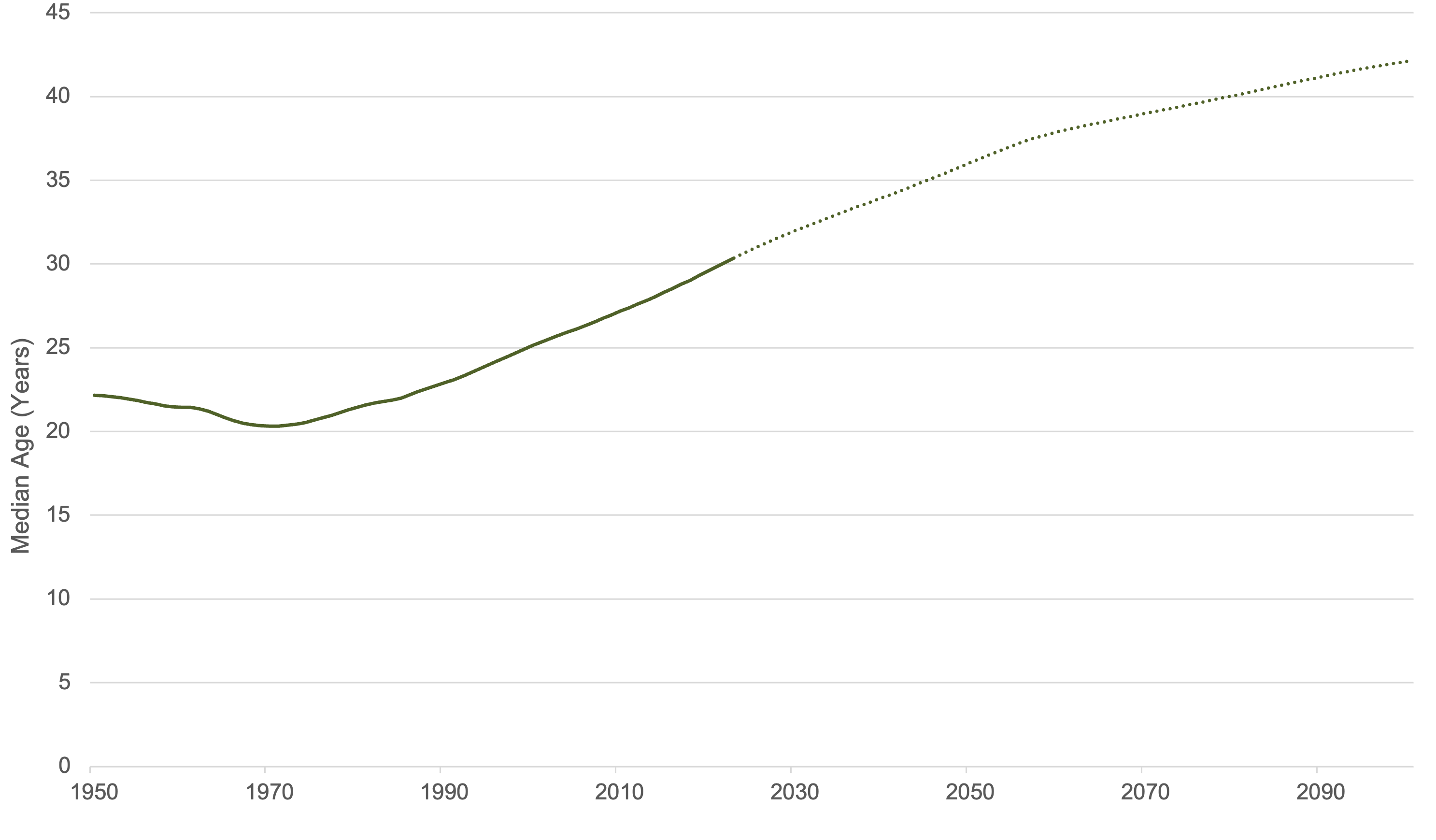

In 1970, the median age of the human race was 20. Today, it’s over 30 and that’s expected to climb to 36 by 2050.8 According to the U.N., the number of human beings 65 and older will reach 1.5 billion by 2050, doubling 2020 levels.9

Exhibit A: Median Age

Source: Our World in Data, UN, World Population Prospects, Fiduciary Trust Company. Last updated July 12, 2024.

As countries grow older, the portion of the population that’s still in the workforce and adding to productivity shrinks while the percentage of retired households gradually grows. Fewer people contributing to economic output tends to slow economic growth. Of course, the economy could still expand as the labor force shrinks provided that productivity rises through other means, such as technology and operational efficiencies. Since 1997, however, global productivity growth has averaged a modest 2%, and about half of those gains were generated from China and India, whose economies are now aging and slowing as a result.10

One gauge of potential demographic risk compares the number of “middle-aged” workers in a population to “older” residents. Economists refer to this as the so-called “MO” ratio. Countries with a high MO ratio — meaning the number of workers aged 40-49 far exceeds older people between 60 and 69 years — tend to have a greater percentage of the population saving and investing, which means there is ample capital flowing in the economy. That, in turn, has the potential to drive growth higher and keep interest rates lower.11

By contrast, countries with low MO ratios have a greater percentage of the population withdrawing money from their portfolios to generate income rather than adding to their investments. This helps explain why developed nations in Europe and Asia with a median age of 40 or older — including Japan (49.9 years old), Italy (48.4), Spain (46.8), Germany (46.8), South Korea (45.5), Switzerland (44.2), France (42.6), the United Kingdom (40.8) and now even China (40.2) — are experiencing slowing growth.12 At the same time, the emerging and frontier markets in Southeast Asia, the Middle East, and Africa with median ages of around 30 or younger have the potential to grow significantly faster. To be sure, the life expectancy in Western Europe and Japan is decidedly older than in the emerging markets. Nevertheless, that 30-something in India or Saudi Arabia would still have three decades of working and saving ahead of them, driving growth.

Where Does the U.S. Stand Demographically?

The United States is an interesting case, demographically speaking. Based solely on the number of middle-aged Americans there are today compared to older people, the country might appear to be as vulnerable as many of its developed market counterparts in Western Europe and Asia. For instance, America’s MO ratio currently stands at around 1, meaning there are about as many 40-49 year olds as there are 60-69 year olds. By comparison, China’s MO ratio is around 1.3 and India’s ratio is closer to 2.13

However, America’s MO ratio is expected to climb in the coming years.14 Part of this is due to the fact that the much-larger Millennial generation will be entering its 40s and peak earnings years in the next two decades at the same time the smaller Gen X generation is about to hit its 60s.

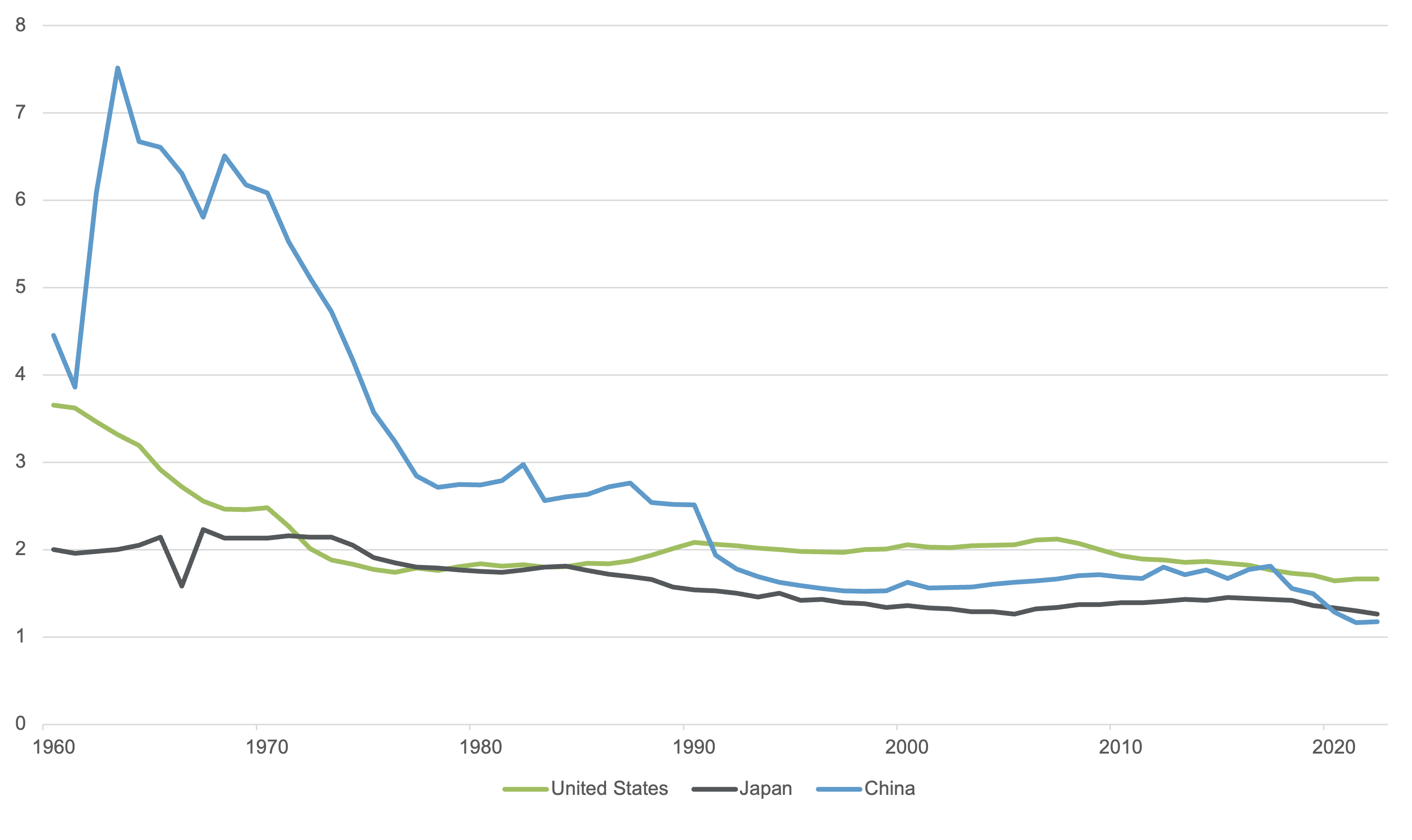

Meanwhile, the U.S. labor force is continuing to grow15 while China’s workforce has been falling since 2015.16 This is, in part, owing to the relatively higher fertility rates in the United States, where there are 1.7 children per woman compared with 1.2 in China.17 As a result, the median age of Americans is a relatively youthful 38.9, younger than China and roughly on par with emerging markets such as Singapore and Iceland.18 The growing labor force is also owing to broader immigration in the United States compared with places like Japan and China. This could point to better relative growth potential — and stock market returns — here at home in the coming decades.

Exhibit B: Births per Woman

Source: World Bank, Fiduciary Trust Company.

Aging & Inflation

With growth, of course, comes the potential for inflation, and the relationship between aging and inflation is a complicated one. The experience of Japan and China would indicate that aging populations lead to deflationary pressures in the economy, as demand dynamics are likely to deteriorate as the ratio of workers to retirees shrinks. One study of 30 OECD countries between 1960 and 2013 found that while population growth tends to be inflationary, a rise in the share of the population older than 65 is deflationary.19

However, there are nuances to consider. For example, deflation doesn’t occur in a vacuum. The Federal Reserve and other central banks around the world have historically met the threat of deflation by lowering interest rates in an attempt to induce growth, which ultimately produces inflation.20

Moreover, even if the aging population leads to deflation across the broad economy, disruptions in the labor market caused by demographic shifts could lead to pockets of inflation in individual sectors. Indeed, the aging workforce is already leading to shortages in specific labor pools in the United States, such as among doctors and nurses, computer engineers, accountants, financial advisors, and skilled tradespeople. The need for more workers in those industries can lead to rising wages in those pockets of the economy, which can directly impact costs for consumers and profit considerations for investors. Those shortages are also leading to opportunities for technology solutions, such as artificial intelligence (AI).

What This Means for Investors

The aging global population will have significant implications for investors not just for the coming years, but for the coming decades as long-term demographic trends play out. At the very least, the aging world is creating opportunities in sectors like healthcare, biotech, financial services and tourism, while adding risks to labor-intensive businesses. These demographic shifts won’t merely affect specific industries, they could also influence allocation decisions across regions and countries while resetting expectations for overall economic growth.

There’s another changing demographic to consider: As investors are themselves aging, their collective appetite for risk-taking may change, affecting how the markets perform going forward.

As the dynamic is changing, having a trusted advisor can help you understand the potential implications of these shifting demographics. If you would like to discuss how Fiduciary Trust Company can help you achieve your financial and personal goals, please reach out to Sid Queler at squeler@fiduciary-trust.com.